library(PrjThaiHFID)

library(dplyr)

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, union

library(tidyr)

library(readr)

library(forcats)

library(ggplot2)

library(kableExtra)

#>

#> Attaching package: 'kableExtra'

#> The following object is masked from 'package:dplyr':

#>

#> group_rowsShared parameters

bl_save_figs <- FALSE

cbp1 <- c(

"#999999", "#E69F00", "#56B4E9", "#009E73",

"#F0E442", "#0072B2", "#D55E00", "#CC79A7"

)Categories and tabulations

# code to prepare `tstm_loans` dataset goes here

# 1000. Generate Loan IDs and MISC ----

# tstm_loans <- PrjThaiHFID::tstm_loans

# Unique ID for each loan

tstm_loans <- tstm_loans %>%

select(

S_region, provid_Num, vilid_Num, hhid_Num, surveymonth,

formal, institutional, G_LenderType,

everything()

) %>%

drop_na(G_Loan_Repaid_Length) %>%

arrange(hhid_Num, surveymonth, G_Loan_Repaid_Length) %>%

mutate(loan_id = row_number())

# Tally loan types and drop NA

tstm_loans %>%

group_by(G_LenderType) %>%

tally()

#> # A tibble: 10 × 2

#> G_LenderType n

#> <chr> <int>

#> 1 Agri Coop 577

#> 2 BAAC 3396

#> 3 Commercial Bank 64

#> 4 MoneyLender 625

#> 5 Neighbor 998

#> 6 Other Non-Indi Formal or Informal 4659

#> 7 Others 1349

#> 8 PCG 501

#> 9 Relatives 1363

#> 10 Village Fund 7408

tstm_loans %>%

group_by(G_LenderType, G_Location) %>%

tally() %>%

spread(G_Location, n)

#> # A tibble: 10 × 5

#> # Groups: G_LenderType [10]

#> G_LenderType `Changwat and Out` `Tambon or Amphoe` Village `<NA>`

#> <chr> <int> <int> <int> <int>

#> 1 Agri Coop 29 547 1 NA

#> 2 BAAC 757 2636 2 1

#> 3 Commercial Bank 17 46 1 NA

#> 4 MoneyLender 162 201 260 2

#> 5 Neighbor 3 20 975 NA

#> 6 Other Non-Indi Formal o… 773 1146 2732 8

#> 7 Others 555 506 272 16

#> 8 PCG 3 9 489 NA

#> 9 Relatives 220 433 705 5

#> 10 Village Fund 9 251 7148 NAReview formal, informal, and joint loan categories.

tstm_loans %>%

group_by(G_LenderType, formal) %>%

tally() %>%

spread(formal, n)

#> # A tibble: 10 × 3

#> # Groups: G_LenderType [10]

#> G_LenderType `FALSE` `TRUE`

#> <chr> <int> <int>

#> 1 Agri Coop 577 NA

#> 2 BAAC NA 3396

#> 3 Commercial Bank NA 64

#> 4 MoneyLender 625 NA

#> 5 Neighbor 998 NA

#> 6 Other Non-Indi Formal or Informal 2732 1927

#> 7 Others 1349 NA

#> 8 PCG 501 NA

#> 9 Relatives 1363 NA

#> 10 Village Fund NA 7408

tstm_loans %>%

group_by(institutional, G_LenderType, formal) %>%

tally() %>%

spread(formal, n)

#> # A tibble: 10 × 4

#> # Groups: institutional, G_LenderType [10]

#> institutional G_LenderType `FALSE` `TRUE`

#> <lgl> <chr> <int> <int>

#> 1 FALSE MoneyLender 625 NA

#> 2 FALSE Neighbor 998 NA

#> 3 FALSE Others 1349 NA

#> 4 FALSE Relatives 1363 NA

#> 5 TRUE Agri Coop 577 NA

#> 6 TRUE BAAC NA 3396

#> 7 TRUE Commercial Bank NA 64

#> 8 TRUE Other Non-Indi Formal or Informal 2732 1927

#> 9 TRUE PCG 501 NA

#> 10 TRUE Village Fund NA 7408

tstm_loans %>%

group_by(institutional, G_LenderType, formalqf) %>%

tally() %>%

spread(formalqf, n)

#> # A tibble: 10 × 4

#> # Groups: institutional, G_LenderType [10]

#> institutional G_LenderType `FALSE` `TRUE`

#> <lgl> <chr> <int> <int>

#> 1 FALSE MoneyLender 625 NA

#> 2 FALSE Neighbor 998 NA

#> 3 FALSE Others 1349 NA

#> 4 FALSE Relatives 1363 NA

#> 5 TRUE Agri Coop NA 577

#> 6 TRUE BAAC NA 3396

#> 7 TRUE Commercial Bank NA 64

#> 8 TRUE Other Non-Indi Formal or Informal 2732 1927

#> 9 TRUE PCG NA 501

#> 10 TRUE Village Fund NA 7408

tstm_loans %>%

group_by(institutional, G_LenderType, forinfm3) %>%

tally() %>%

spread(forinfm3, n)

#> # A tibble: 10 × 5

#> # Groups: institutional, G_LenderType [10]

#> institutional G_LenderType Formal Informal `Quasi-formal`

#> <lgl> <chr> <int> <int> <int>

#> 1 FALSE MoneyLender NA 625 NA

#> 2 FALSE Neighbor NA 998 NA

#> 3 FALSE Others NA 1349 NA

#> 4 FALSE Relatives NA 1363 NA

#> 5 TRUE Agri Coop NA NA 577

#> 6 TRUE BAAC 3396 NA NA

#> 7 TRUE Commercial Bank 64 NA NA

#> 8 TRUE Other Non-Indi Formal or Inform… NA NA 4659

#> 9 TRUE PCG NA NA 501

#> 10 TRUE Village Fund 7408 NA NALoan terms tables

Show in table across loan types loan terms percentiles. This implements PrjThaiHFID-#14.

# Choose latex for paper output

# st_kableformat <- "latex"

st_kableformat <- "html"

# Percentiles of interest

# ar_fl_percentiles <- seq(0.01, 0.99, length.out = 99)

# ar_fl_percentiles <- seq(0.01, 0.99, length.out = 50)

# ar_fl_percentiles <- seq(0.02, 0.98, length.out = 33)

# ar_fl_percentiles <- seq(0.05, 0.95, length.out = 19)

# ar_fl_percentiles <- c(0.1, 0.25, 0.50, 0.75, 0.9, 0.95, 0.99)

ar_fl_percentiles <- c(

0.05, 0.10, 0.20, 0.30, 0.40,

0.25, 0.50, 0.75,

0.60, 0.70, 0.80, 0.9, 0.95)

# ar_fl_percentiles <- seq(0.10, 0.90, length.out=9)Data prep part 1: rename and reshape

We loaded in tstm_loans already.

First select loanID, forinfm3, term, and do so separately for each term, separate files.

# Select files

tstm_loans_sel <- tstm_loans %>%

select(

loan_id, forinfm3,

G_Loan_Init_Length, S_Init_Amount, G_Loan_Init_IntMthlyRat

) %>%

rename(

id = loan_id,

loan_1length = G_Loan_Init_Length,

loan_2amount = S_Init_Amount,

loan_3interest = G_Loan_Init_IntMthlyRat

)

# rename formal, quasi, informal

ls_recode_forinfm3 <- c(

"Aformal" = "Formal",

"Bquasiformal" = "Quasi-formal",

"Cinformal" = "Informal"

)

tstm_loans_sel <- tstm_loans_sel %>%

mutate(forinfm3 = as.character(

fct_recode(forinfm3, !!!ls_recode_forinfm3)

))Second, reshape wide to long.

# Select files

tstm_loans_sel_long <- tstm_loans_sel %>%

pivot_longer(

cols = starts_with("loan"),

names_to = c("terms"),

names_pattern = paste0("loan_(.*)"),

values_to = "value"

)

# Drop NA

tstm_loans_sel_long <- tstm_loans_sel_long %>%

drop_na(value)Data prep part 2: percentiles

First, compute CDF.

# Generate within-group CDF

tstm_loans_sel_long_pct <- tstm_loans_sel_long %>%

arrange(terms, forinfm3, value) %>%

group_by(terms, forinfm3) %>%

mutate(cdf = row_number() / n())Second, compute percentiles and moments.

# Define strings

st_var_prefix <- "val"

st_var_prefix_perc <- paste0(st_var_prefix, "_p")

svr_mean <- paste0(st_var_prefix, "_mean")

svr_std <- paste0(st_var_prefix, "_std")

# Generate within-group percentiles

for (it_percentile_ctr in seq(1, length(ar_fl_percentiles))) {

# Current within group percentile to compute

fl_percentile <- ar_fl_percentiles[it_percentile_ctr]

# Percentile and mean stats

svr_percentile <- paste0(st_var_prefix_perc, round(fl_percentile * 100))

# Frame with specific percentile

df_within_percentiles_cur <- tstm_loans_sel_long_pct %>%

group_by(terms, forinfm3) %>%

filter(cdf >= fl_percentile) %>%

slice(1) %>%

mutate(!!sym(svr_percentile) := value) %>%

select(terms, forinfm3, one_of(svr_percentile))

# Merge percentile frames together

if (it_percentile_ctr > 1) {

df_within_percentiles <- df_within_percentiles %>%

left_join(df_within_percentiles_cur,

by = c("forinfm3" = "forinfm3", "terms" = "terms")

)

} else {

df_within_percentiles <- df_within_percentiles_cur

}

}

# Add in within group mean

df_within_percentiles_mean <- tstm_loans_sel_long_pct %>%

group_by(terms, forinfm3) %>%

mutate(!!sym(svr_mean) := mean(value, na.rm = TRUE)) %>%

mutate(!!sym(svr_std) := sqrt(mean((value - !!sym(svr_mean))^2))) %>%

slice(1)

# Join to file

df_within_percentiles <- df_within_percentiles %>%

left_join(df_within_percentiles_mean,

by = c("forinfm3" = "forinfm3", "terms" = "terms")

) %>%

select(

terms, forinfm3,

contains(st_var_prefix_perc),

one_of(svr_mean)

# ,

# one_of(svr_std)

)

# display

print(df_within_percentiles)

#> # A tibble: 9 × 16

#> # Groups: terms, forinfm3 [9]

#> terms forinfm3 val_p5 val_p10 val_p20 val_p30 val_p40 val_p25 val_p50 val_p75

#> <chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

#> 1 1len… Aformal 3 e+0 4 e+0 1.1 e+1 1.2 e+1 1.2 e+1 1.2 e+1 1.2 e+1 1.3 e+1

#> 2 1len… Bquasif… 3 e+0 5 e+0 7 e+0 1 e+1 1.2 e+1 8 e+0 1.2 e+1 1.3 e+1

#> 3 1len… Cinform… 0 0 1 e+0 1 e+0 2 e+0 1 e+0 3 e+0 8 e+0

#> 4 2amo… Aformal 5 e+3 5 e+3 1 e+4 1.3 e+4 1.6 e+4 1.10e+4 2 e+4 3 e+4

#> 5 2amo… Bquasif… 1 e+3 1.4 e+3 2 e+3 2.38e+3 3 e+3 2 e+3 5 e+3 1.5 e+4

#> 6 2amo… Cinform… 6.3 e+2 1 e+3 1.8 e+3 2.7 e+3 5 e+3 2 e+3 6 e+3 2 e+4

#> 7 3int… Aformal 2.31e-3 3.08e-3 4.62e-3 4.62e-3 5.00e-3 4.62e-3 5.00e-3 6.67e-3

#> 8 3int… Bquasif… 0 0 0 1.16e-9 3.33e-3 0 4.47e-3 1.00e-2

#> 9 3int… Cinform… 0 0 0 0 0 0 7.08e-3 3.00e-2

#> # ℹ 6 more variables: val_p60 <dbl>, val_p70 <dbl>, val_p80 <dbl>,

#> # val_p90 <dbl>, val_p95 <dbl>, val_mean <dbl>Data prep part 3: transpose percentiles

First, combine all rows together and combine blnc_vars

and ivars. Do not resort, preserve existing orders. Drop

the mean, not informative.

# Bind rows for selected key results:

df_within_percentiles <- df_within_percentiles %>%

ungroup() %>%

mutate(

cate_jnt = paste0(terms, "_j_", forinfm3)

) %>%

select(

cate_jnt, -terms, -forinfm3,

contains(st_var_prefix)

)Second, reshape wide to long then to wide again to transpose.

df_within_percentiles_trans <- df_within_percentiles %>%

pivot_longer(

cols = starts_with(st_var_prefix),

names_to = c("percentile"),

names_pattern = paste0(st_var_prefix, "_(.*)"),

values_to = "value"

) %>%

pivot_wider(

names_from = cate_jnt,

values_from = value

)Third, formatting. Length, levels, percentages. percentage formatting.

# format percentiles

df_within_percentiles_trans <- df_within_percentiles_trans %>%

mutate(percentile = gsub(

percentile, pattern="p", replace=""))

# format length

df_within_percentiles_trans <- df_within_percentiles_trans %>%

mutate_at(

vars(contains("1length_")),

list(~ paste0(

format(round(., 1),

nsmall = 1,

big.mark = ","

)

))

)

# format length

df_within_percentiles_trans <- df_within_percentiles_trans %>%

mutate_at(

vars(contains("2amount_")),

list(~ paste0(

format(round(., 0),

nsmall = 0,

big.mark = ","

)

))

)

# format interest rates

df_within_percentiles_trans <- df_within_percentiles_trans %>%

mutate_at(

vars(contains("3interest_")),

list(~ paste0(

format(round(. *100, 2),

nsmall = 2,

big.mark = ","

),

"%"

))

)Table display (full table)

We present full information with lower and upper deciles, formal, informal, and quasiformal information jointly.

# First, we define column names, which correspond to previously defined variable selection list.

ar_st_col_names <- c(

"Percentiles",

"Formal", "Quasi-formal", "Informal",

"Formal", "Quasi-formal", "Informal",

"Formal", "Quasi-formal", "Informal"

)

# Define column groups, grouping the names above

ar_st_col_groups <- c(

" " = 1,

"Length (months)" = 3,

"Amount (baht)" = 3,

"Interest (monthly)" = 3

)

# Define column groups, grouping the names above

ar_st_col_groups_super <- c(

" " = 1,

"Loan terms" = 9

)

# Second, we construct main table, and add styling.

bk_loan_terms <- kbl(

df_within_percentiles_trans,

format = st_kableformat,

# escape = F,

linesep = "",

booktabs = T,

align = "c",

caption = "Loan terms distributions.",

col.names = ar_st_col_names

) %>%

# see https://cran.r-project.org/web/packages/kableExtra/vignettes/awesome_table_in_html.html#Bootstrap_table_classes

kable_styling(

bootstrap_options = c("striped", "hover", "condensed", "responsive"),

full_width = F, position = "left"

)

# Third, we add in row groups

bk_loan_terms <- bk_loan_terms %>%

add_header_above(ar_st_col_groups)

# add_header_above(ar_st_col_groups_super)

# Fourth, we add in column groups.

bk_loan_terms <- bk_loan_terms %>%

pack_rows(

"Below median deciles",

1, 5,

latex_gap_space = "0.5em"

) %>%

pack_rows(

"Quartiles",

6, 8,

latex_gap_space = "0.5em", hline_before = F

) %>%

pack_rows(

"Above median deciles",

9, 13,

latex_gap_space = "0.5em", hline_before = F

) %>%

pack_rows(

"Mean",

14, 14,

latex_gap_space = "0.5em", hline_before = F

)

# Fifth, column formatting.

bk_loan_terms <- bk_loan_terms %>%

column_spec(1, width = "2.0cm") %>%

column_spec(2:10, width = "1.6cm")

# Final adjustments

st_texcmd <- "frac"

bk_loan_terms <- gsub(bk_loan_terms,

pattern = paste0("\\textbackslash{}", st_texcmd, "\\"),

replacement = paste0("\\", st_texcmd), fixed = TRUE

)

st_texcmd <- "text"

bk_loan_terms <- gsub(bk_loan_terms,

pattern = paste0("\\textbackslash{}", st_texcmd, "\\"),

replacement = paste0("\\", st_texcmd), fixed = TRUE

)

bk_loan_terms <- gsub(bk_loan_terms,

pattern = "\\}\\{",

replacement = "}{", fixed = TRUE

)

bk_loan_terms <- gsub(bk_loan_terms,

pattern = "\\}",

replacement = "}", fixed = TRUE

)

bk_loan_terms <- gsub(bk_loan_terms,

pattern = "\\$",

replacement = "$", fixed = TRUE

)

# Sixth, display.

# pl_bk_asset_count <- bk_loan_terms %>% as_image()

bk_loan_terms| Percentiles | Formal | Quasi-formal | Informal | Formal | Quasi-formal | Informal | Formal | Quasi-formal | Informal |

|---|---|---|---|---|---|---|---|---|---|

| Below median deciles | |||||||||

| 5 | 3.0 | 3.0 | 0.0 | 5,000 | 1,000 | 630 | 0.23% | 0.00% | 0.00% |

| 10 | 4.0 | 5.0 | 0.0 | 5,000 | 1,400 | 1,000 | 0.31% | 0.00% | 0.00% |

| 20 | 11.0 | 7.0 | 1.0 | 10,000 | 2,000 | 1,800 | 0.46% | 0.00% | 0.00% |

| 30 | 12.0 | 10.0 | 1.0 | 13,000 | 2,380 | 2,700 | 0.46% | 0.00% | 0.00% |

| 40 | 12.0 | 12.0 | 2.0 | 16,000 | 3,000 | 5,000 | 0.50% | 0.33% | 0.00% |

| Quartiles | |||||||||

| 25 | 12.0 | 8.0 | 1.0 | 11,000 | 2,000 | 2,000 | 0.46% | 0.00% | 0.00% |

| 50 | 12.0 | 12.0 | 3.0 | 20,000 | 5,000 | 6,000 | 0.50% | 0.45% | 0.71% |

| 75 | 13.0 | 13.0 | 8.0 | 30,000 | 15,000 | 20,000 | 0.67% | 1.00% | 3.00% |

| Above median deciles | |||||||||

| 60 | 12.0 | 12.0 | 5.0 | 20,000 | 6,000 | 10,000 | 0.58% | 0.69% | 2.00% |

| 70 | 13.0 | 13.0 | 7.0 | 20,000 | 10,000 | 15,000 | 0.62% | 0.92% | 2.62% |

| 80 | 13.0 | 18.0 | 10.0 | 30,000 | 23,520 | 20,000 | 0.75% | 1.00% | 4.00% |

| 90 | 13.0 | 26.0 | 13.0 | 50,000 | 50,000 | 45,000 | 1.00% | 1.85% | 6.25% |

| 95 | 13.0 | 60.0 | 13.0 | 90,000 | 108,750 | 110,000 | 1.27% | 3.00% | 9.23% |

| Mean | |||||||||

| mean | 12.8 | 15.5 | 5.8 | 31,876 | 27,271 | 22,628 | 0.80% | 0.86% | 2.36% |

Table display (partial table)

We now present a subset of information contained in the prior table, we focus on just the quartiles and exclude quasi-formal.

First, we select a subset of the table to consider only quartiles and exclude quasi-formal.

df_within_percentiles_trans_sel <- df_within_percentiles_trans %>%

filter(percentile %in% c("25", "50", "75","mean")) %>%

select(-contains("quasi"))Second, we generate the plot.

# First, we define column names, which correspond to previously defined variable selection list.

ar_st_col_names <- c(

"",

"Formal", "Informal",

"Formal", "Informal",

"Formal", "Informal"

)

# Define column groups, grouping the names above

ar_st_col_groups <- c(

" " = 1,

"Length (months)" = 2,

"Amount (baht)" = 2,

"Interest (monthly)" = 2

)

# Define column groups, grouping the names above

ar_st_col_groups_super <- c(

" " = 1,

"Loan terms" = 6

)

# Second, we construct main table, and add styling.

bk_loan_qrt_terms <- kbl(

df_within_percentiles_trans_sel,

format = st_kableformat,

# escape = F,

linesep = "",

booktabs = T,

align = "c",

caption = "Loan terms distributions.",

col.names = ar_st_col_names

) %>%

# see https://cran.r-project.org/web/packages/kableExtra/vignettes/awesome_table_in_html.html#Bootstrap_table_classes

kable_styling(

bootstrap_options = c("striped", "hover", "condensed", "responsive"),

full_width = F, position = "left"

)

# Third, we add in row groups

bk_loan_qrt_terms <- bk_loan_qrt_terms %>%

add_header_above(ar_st_col_groups)

# add_header_above(ar_st_col_groups_super)

# Fourth, we add in column groups.

bk_loan_qrt_terms <- bk_loan_qrt_terms %>%

pack_rows(

"Quartiles",

1, 3,

latex_gap_space = "0.5em", hline_before = F

) %>%

pack_rows(

"Mean",

4, 4,

latex_gap_space = "0.5em", hline_before = F

)

# Fifth, column formatting.

bk_loan_qrt_terms <- bk_loan_qrt_terms %>%

column_spec(1, width = "2.0cm") %>%

column_spec(2:7, width = "1.6cm")

# Final adjustments

st_texcmd <- "frac"

bk_loan_qrt_terms <- gsub(bk_loan_qrt_terms,

pattern = paste0("\\textbackslash{}", st_texcmd, "\\"),

replacement = paste0("\\", st_texcmd), fixed = TRUE

)

st_texcmd <- "text"

bk_loan_qrt_terms <- gsub(bk_loan_qrt_terms,

pattern = paste0("\\textbackslash{}", st_texcmd, "\\"),

replacement = paste0("\\", st_texcmd), fixed = TRUE

)

bk_loan_qrt_terms <- gsub(bk_loan_qrt_terms,

pattern = "\\}\\{",

replacement = "}{", fixed = TRUE

)

bk_loan_qrt_terms <- gsub(bk_loan_qrt_terms,

pattern = "\\}",

replacement = "}", fixed = TRUE

)

bk_loan_qrt_terms <- gsub(bk_loan_qrt_terms,

pattern = "\\$",

replacement = "$", fixed = TRUE

)

# Sixth, display.

# pl_bk_asset_count <- bk_loan_qrt_terms %>% as_image()

bk_loan_qrt_terms| Formal | Informal | Formal | Informal | Formal | Informal | |

|---|---|---|---|---|---|---|

| Quartiles | ||||||

| 25 | 12.0 | 1.0 | 11,000 | 2,000 | 0.46% | 0.00% |

| 50 | 12.0 | 3.0 | 20,000 | 6,000 | 0.50% | 0.71% |

| 75 | 13.0 | 8.0 | 30,000 | 20,000 | 0.67% | 3.00% |

| Mean | ||||||

| mean | 12.8 | 5.8 | 31,876 | 22,628 | 0.80% | 2.36% |

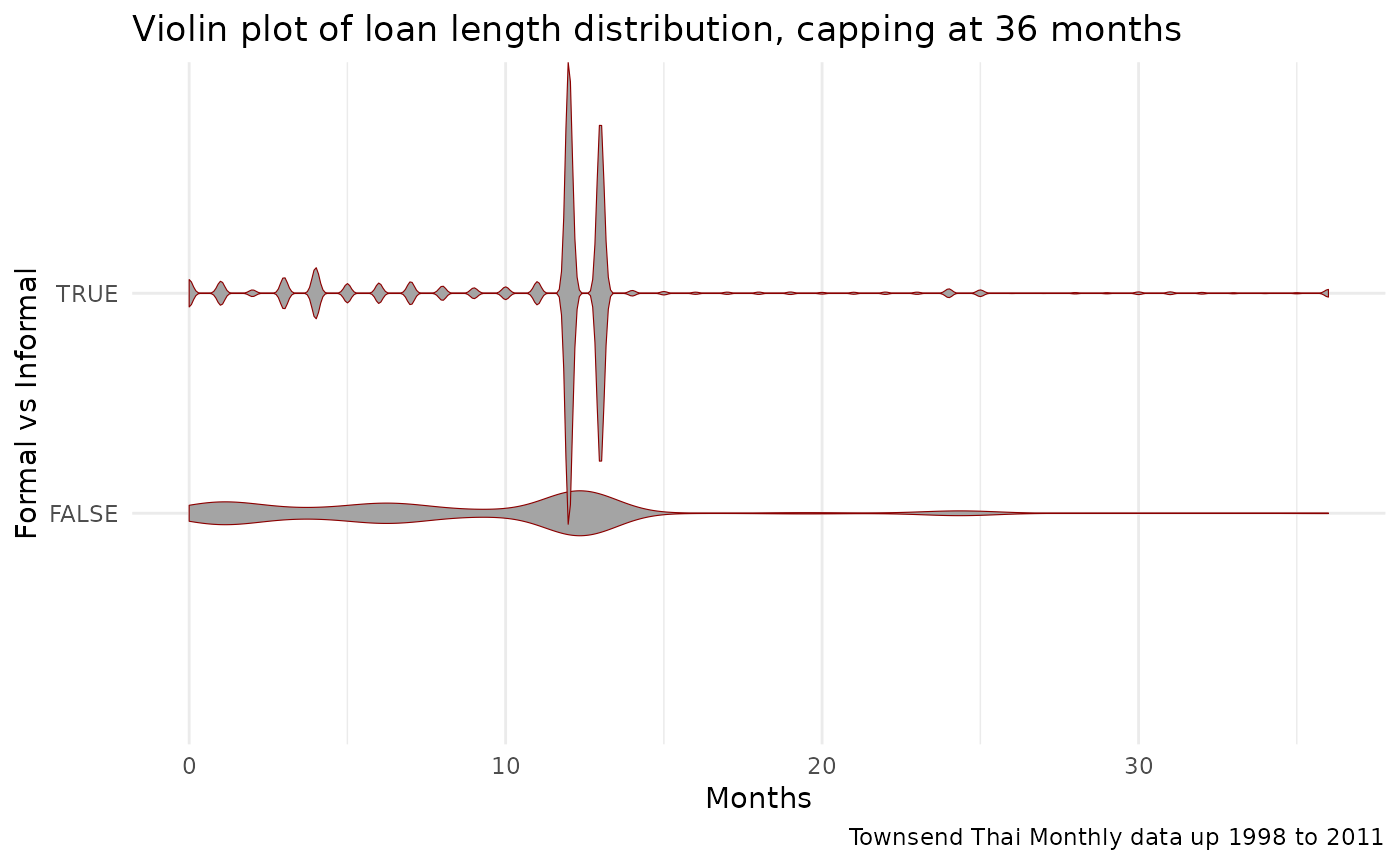

Loan length distribution

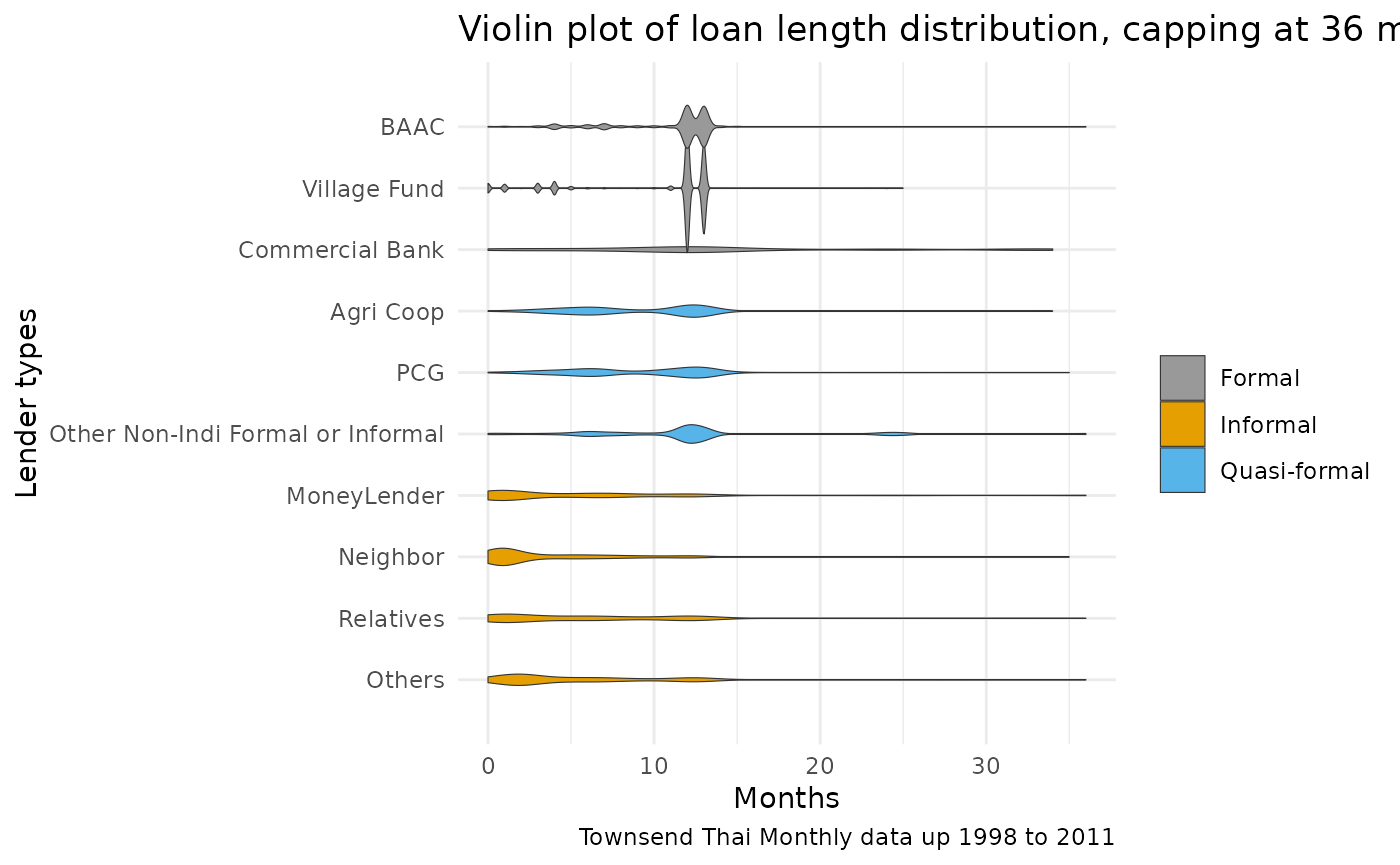

Loan length all loan type violin plot

We show the distribution of all loan types as violins.

pl_violin_loan_length_all <- tstm_loans %>%

filter(G_Loan_Init_Length <= 36) %>%

ggplot(aes(

x = factor(G_LenderType,

levels = rev(c(

"BAAC",

"Village Fund",

"Commercial Bank",

"Agri Coop",

"PCG",

"Other Non-Indi Formal or Informal",

"MoneyLender",

"Neighbor",

"Relatives",

"Others"

))

), y = G_Loan_Init_Length,

fill = forinfm3

)) +

geom_violin(

width = 2.1, size = 0.2

) +

scale_fill_manual(values = cbp1, name = "") +

theme_minimal() +

coord_flip() +

labs(

y = paste0("Months"),

x = paste0("Lender types"),

title = paste(

"Violin plot of loan length distribution, capping at 36 months",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

#> Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

#> ℹ Please use `linewidth` instead.

#> This warning is displayed once every 8 hours.

#> Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

#> generated.

print(pl_violin_loan_length_all)

#> Warning: `position_dodge()` requires non-overlapping x

#> intervals.

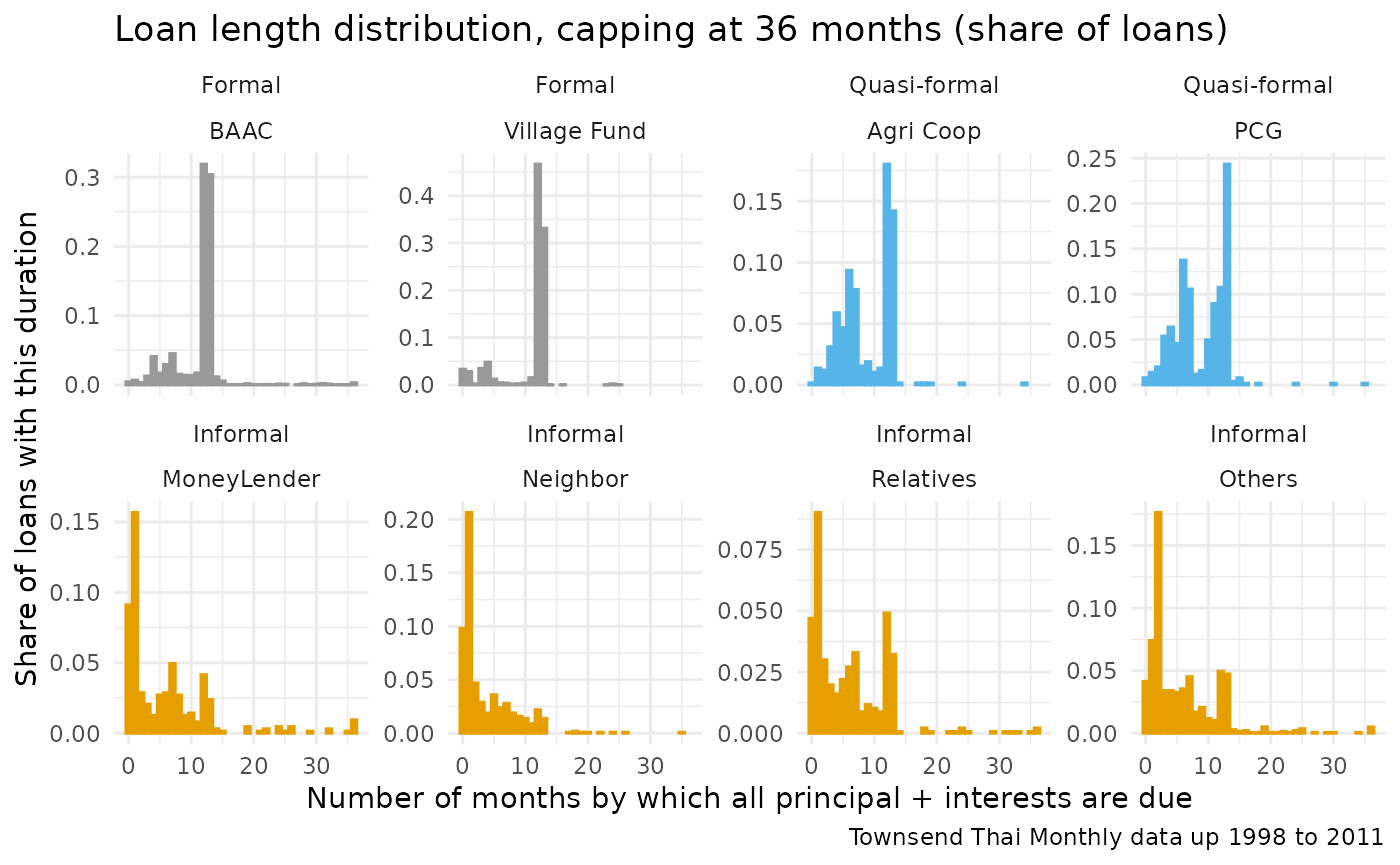

Loan length eight key categories

Loan length distribution among eight selected key categories.

First, in shares.

# We will first count the number of loans by type and month

pl_bar_loan_length_1a <- tstm_loans %>%

ungroup() %>%

filter(

G_LenderType != "Other Non-Indi Formal or Informal",

G_LenderType != "Commercial Bank",

) %>%

group_by(forinfm3, G_LenderType, G_Loan_Init_Length) %>%

summarize(group_len_count = n()) %>%

ungroup() %>%

group_by(forinfm3, G_LenderType) %>%

mutate(group_count = sum(group_len_count)) %>%

mutate(group_len_share = group_len_count / group_count) %>%

filter(G_Loan_Init_Length <= 36) %>%

ggplot(aes(

x = G_Loan_Init_Length, y = group_len_share,

fill = forinfm3, color = forinfm3

)) +

geom_bar(stat = "identity") +

facet_wrap(factor(forinfm3, c(

"Formal",

"Quasi-formal",

"Informal"

)) ~

factor(G_LenderType,

levels = c(

"MoneyLender",

"Neighbor",

"Relatives",

"Others",

"BAAC",

"Village Fund",

# 'Commercial Bank',

"Agri Coop",

"PCG"

)

), scales = "free_y", ncol = 4) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

guides(color = FALSE, fill = FALSE) +

theme_minimal() +

labs(

x = paste0("Number of months by which all principal + interests are due"),

y = paste0("Share of loans with this duration"),

title = paste(

"Loan length distribution, capping at 36 months (share of loans)",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

#> `summarise()` has grouped output by 'forinfm3', 'G_LenderType'. You can

#> override using the `.groups` argument.

#> Warning: The `<scale>` argument of `guides()` cannot be `FALSE`. Use "none" instead as

#> of ggplot2 3.3.4.

#> This warning is displayed once every 8 hours.

#> Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

#> generated.

print(pl_bar_loan_length_1a)

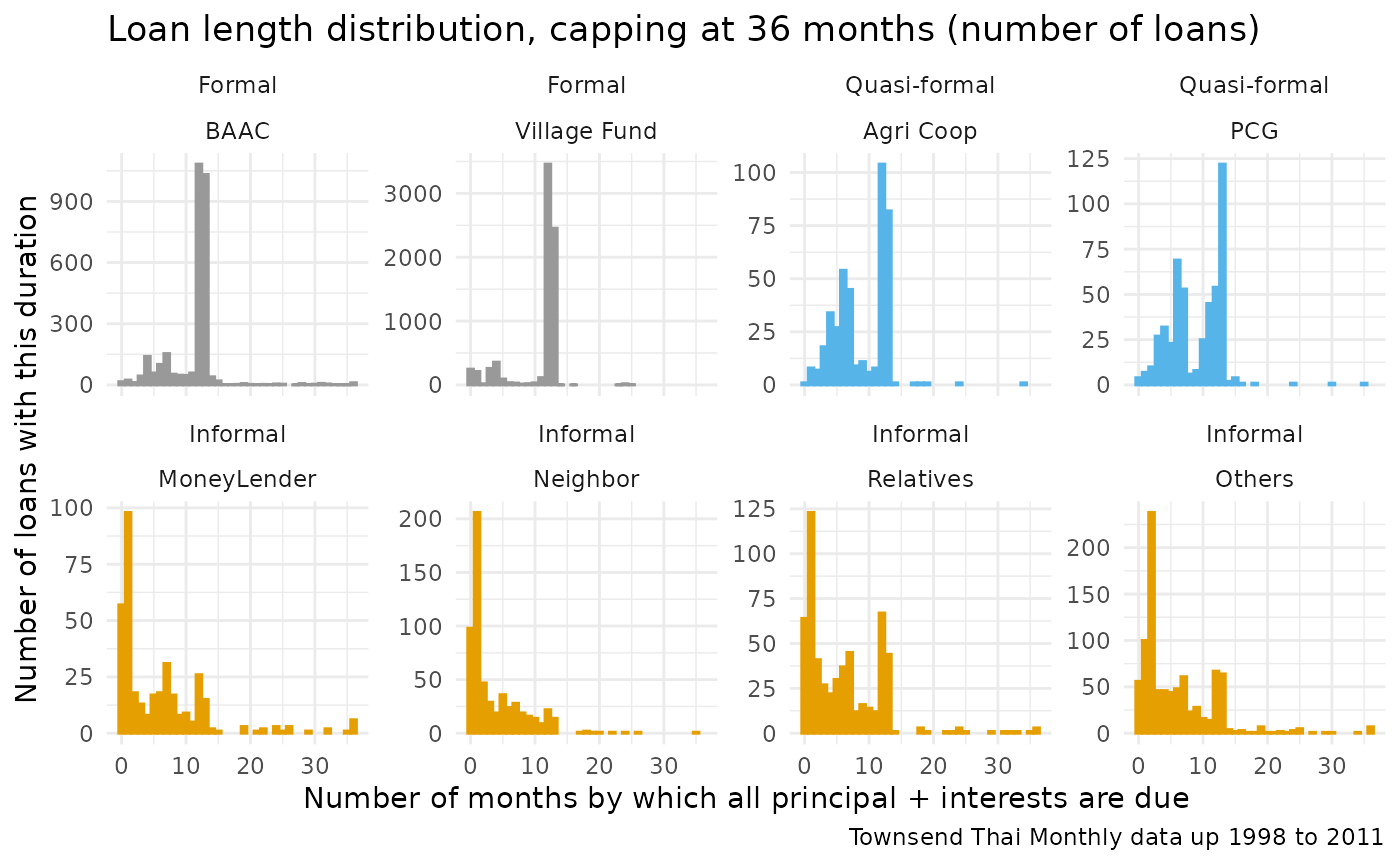

Second, in levels (frequency of loans).

# We will first count the number of loans by type and month

pl_bar_loan_length_1b <- tstm_loans %>%

ungroup() %>%

filter(

G_LenderType != "Other Non-Indi Formal or Informal",

G_LenderType != "Commercial Bank",

) %>%

group_by(forinfm3, G_LenderType, G_Loan_Init_Length) %>%

summarize(group_len_count = n()) %>%

ungroup() %>%

group_by(forinfm3, G_LenderType) %>%

mutate(group_count = sum(group_len_count)) %>%

mutate(group_len_share = group_len_count / group_count) %>%

filter(G_Loan_Init_Length <= 36) %>%

ggplot(aes(

x = G_Loan_Init_Length, y = group_len_count,

fill = forinfm3, color = forinfm3

)) +

geom_bar(stat = "identity") +

facet_wrap(factor(forinfm3, c(

"Formal",

"Quasi-formal",

"Informal"

)) ~

factor(G_LenderType,

levels = c(

"MoneyLender",

"Neighbor",

"Relatives",

"Others",

"BAAC",

"Village Fund",

# 'Commercial Bank',

"Agri Coop",

"PCG"

)

), scales = "free_y", ncol = 4) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

guides(color = FALSE, fill = FALSE) +

theme_minimal() +

labs(

x = paste0("Number of months by which all principal + interests are due"),

y = paste0("Number of loans with this duration"),

title = paste(

"Loan length distribution, capping at 36 months (number of loans)",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

#> `summarise()` has grouped output by 'forinfm3', 'G_LenderType'. You can

#> override using the `.groups` argument.

print(pl_bar_loan_length_1b)

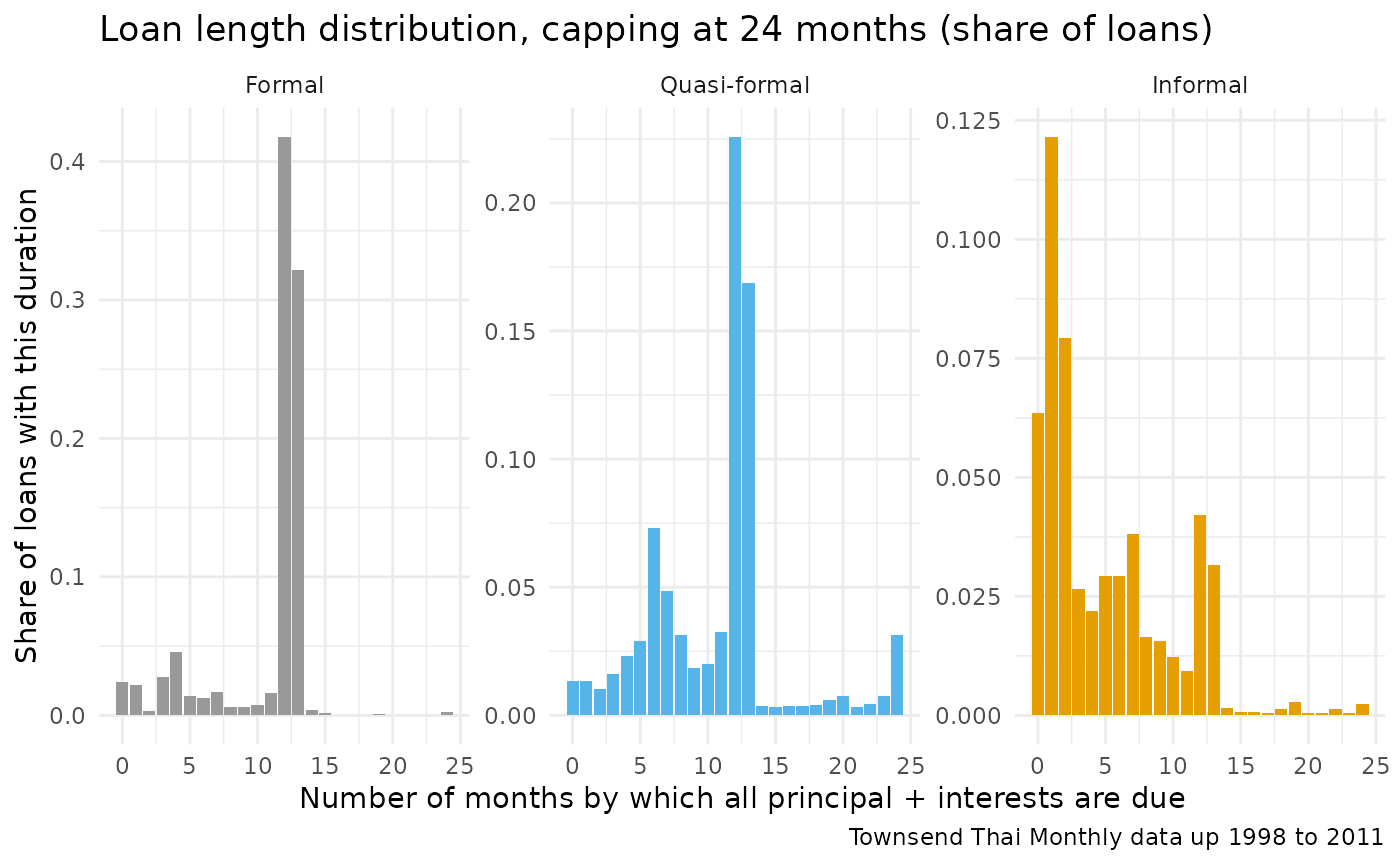

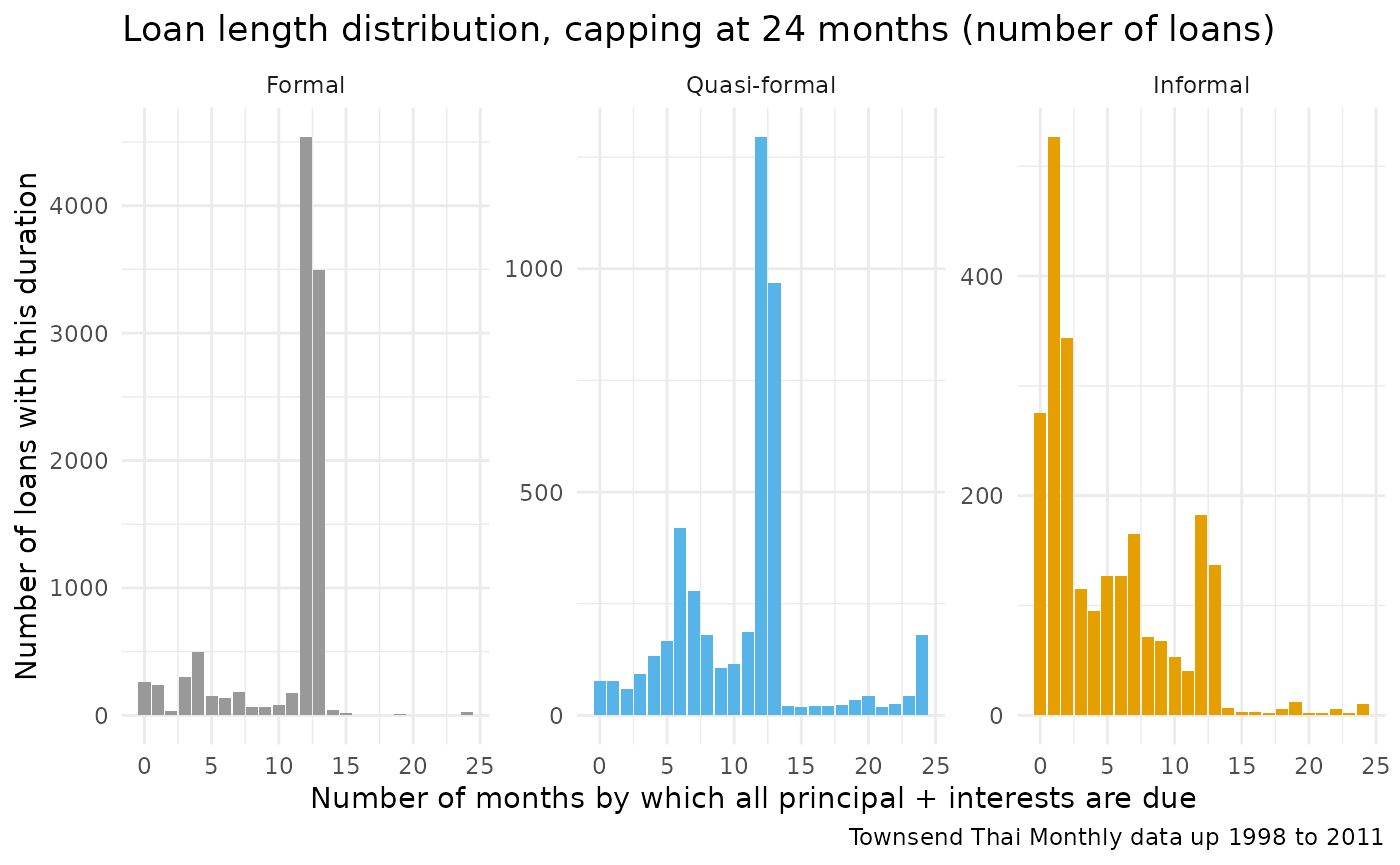

Loan length three categories

Formal, informal, and quasi-formal laon length distribution break-down.

First, we visualize with share of loans.

# We will first count the number of loans by type and month

pl_bar_loan_length_2a <- tstm_loans %>%

ungroup() %>%

# filter(G_LenderType != "Other Non-Indi Formal or Informal",

# G_LenderType != "Commercial Bank",) %>%

group_by(forinfm3, G_Loan_Init_Length) %>%

summarize(group_len_count = n()) %>%

ungroup() %>%

group_by(forinfm3) %>%

mutate(group_count = sum(group_len_count)) %>%

mutate(group_len_share = group_len_count / group_count) %>%

filter(G_Loan_Init_Length <= 24) %>%

ggplot(aes(

x = G_Loan_Init_Length, y = group_len_share,

fill = forinfm3

)) +

geom_bar(stat = "identity") +

facet_wrap(~ factor(forinfm3,

levels = c(

"Formal",

"Quasi-formal",

"Informal"

)

), scales = "free_y", ncol = 3) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

guides(color = FALSE, fill = FALSE) +

theme_minimal() +

labs(

x = paste0("Number of months by which all principal + interests are due"),

y = paste0("Share of loans with this duration"),

title = paste(

"Loan length distribution, capping at 24 months (share of loans)",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

#> `summarise()` has grouped output by 'forinfm3'. You can override using the

#> `.groups` argument.

print(pl_bar_loan_length_2a)

Second, we visualize with number of loans.

# Frequencies

pl_bar_loan_length_2b <- tstm_loans %>%

ungroup() %>%

# filter(G_LenderType != "Other Non-Indi Formal or Informal",

# G_LenderType != "Commercial Bank",) %>%

group_by(forinfm3, G_Loan_Init_Length) %>%

summarize(group_len_count = n()) %>%

ungroup() %>%

group_by(forinfm3) %>%

mutate(group_count = sum(group_len_count)) %>%

mutate(group_len_share = group_len_count / group_count) %>%

filter(G_Loan_Init_Length <= 24) %>%

ggplot(aes(

x = G_Loan_Init_Length, y = group_len_count,

fill = forinfm3

)) +

geom_bar(stat = "identity") +

facet_wrap(~ factor(forinfm3,

levels = c(

"Formal",

"Quasi-formal",

"Informal"

)

), scales = "free_y", ncol = 3) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

guides(color = FALSE, fill = FALSE) +

theme_minimal() +

labs(

x = paste0("Number of months by which all principal + interests are due"),

y = paste0("Number of loans with this duration"),

title = paste(

"Loan length distribution, capping at 24 months (number of loans)",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

#> `summarise()` has grouped output by 'forinfm3'. You can override using the

#> `.groups` argument.

print(pl_bar_loan_length_2b)

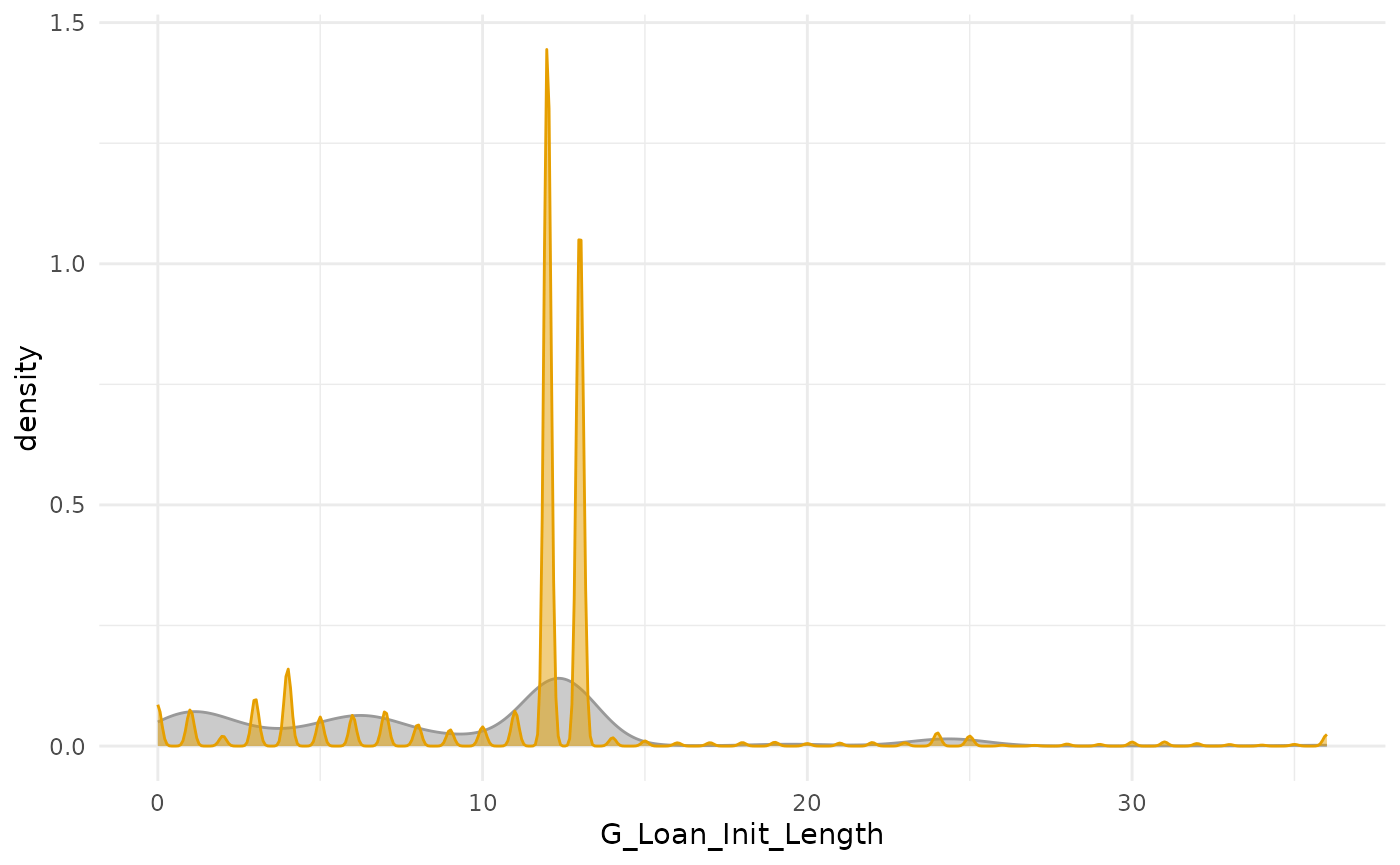

Loan length overall formal and informal

First, fOrmal and informal, density plot.

# We will first count the number of loans by type and month

pl_bar_loan_length_3 <- tstm_loans %>%

filter(G_Loan_Init_Length <= 36) %>%

ggplot(aes(G_Loan_Init_Length,

fill = formal, color = formal

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

guides(color = FALSE, fill = FALSE) +

theme_minimal()

print(pl_bar_loan_length_3)

Second, formal vs informal bifurcation violin plot.

pl_loan_length <- tstm_loans %>%

filter(G_Loan_Init_Length <= 36) %>%

ggplot(aes(x = formal, y = G_Loan_Init_Length)) +

geom_violin(

width = 2.1, size = 0.2,

fill = "#a4a4a4", color = "darkred"

) +

theme_minimal() +

coord_flip() +

labs(

y = paste0("Months"),

x = paste0("Formal vs Informal"),

title = paste(

"Violin plot of loan length distribution, capping at 36 months",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_loan_length)

#> Warning: `position_dodge()` requires non-overlapping x

#> intervals.

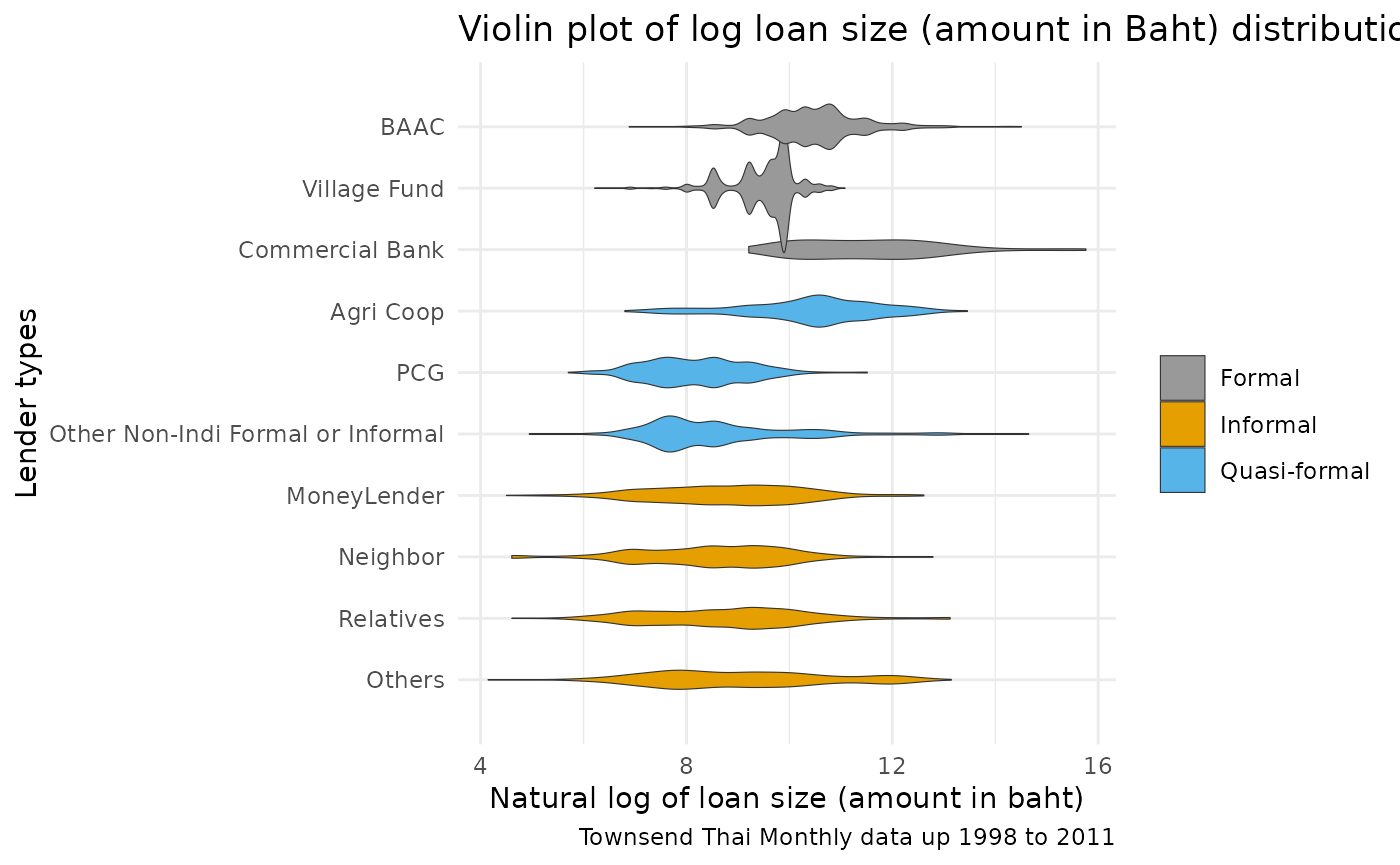

Loan amount distribution

Loan amount all loan type violin plot

Overall and all types of lenders:

# Figure B: Loan Amount by Lender Types

pl_violin_loan_size_all <- tstm_loans %>%

mutate(S_Init_Amount_Log = log(S_Init_Amount)) %>%

# filter(G_Loan_Init_Length <= 24) %>%

ggplot(aes(x = factor(G_LenderType,

levels = rev(c(

"BAAC",

"Village Fund",

"Commercial Bank",

"Agri Coop",

"PCG",

"Other Non-Indi Formal or Informal",

"MoneyLender",

"Neighbor",

"Relatives",

"Others"

))

), y = S_Init_Amount_Log, fill = forinfm3)) +

geom_violin(

width = 2.1, size = 0.2,

) +

scale_fill_manual(values = cbp1, name = "") +

theme_minimal() +

coord_flip() +

labs(

y = paste0("Natural log of loan size (amount in baht)"),

x = paste0("Lender types"),

title = paste(

"Violin plot of log loan size (amount in Baht) distribution",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_violin_loan_size_all)

#> Warning: Removed 12 rows containing non-finite outside the scale range

#> (`stat_ydensity()`).

#> Warning: `position_dodge()` requires non-overlapping x

#> intervals.

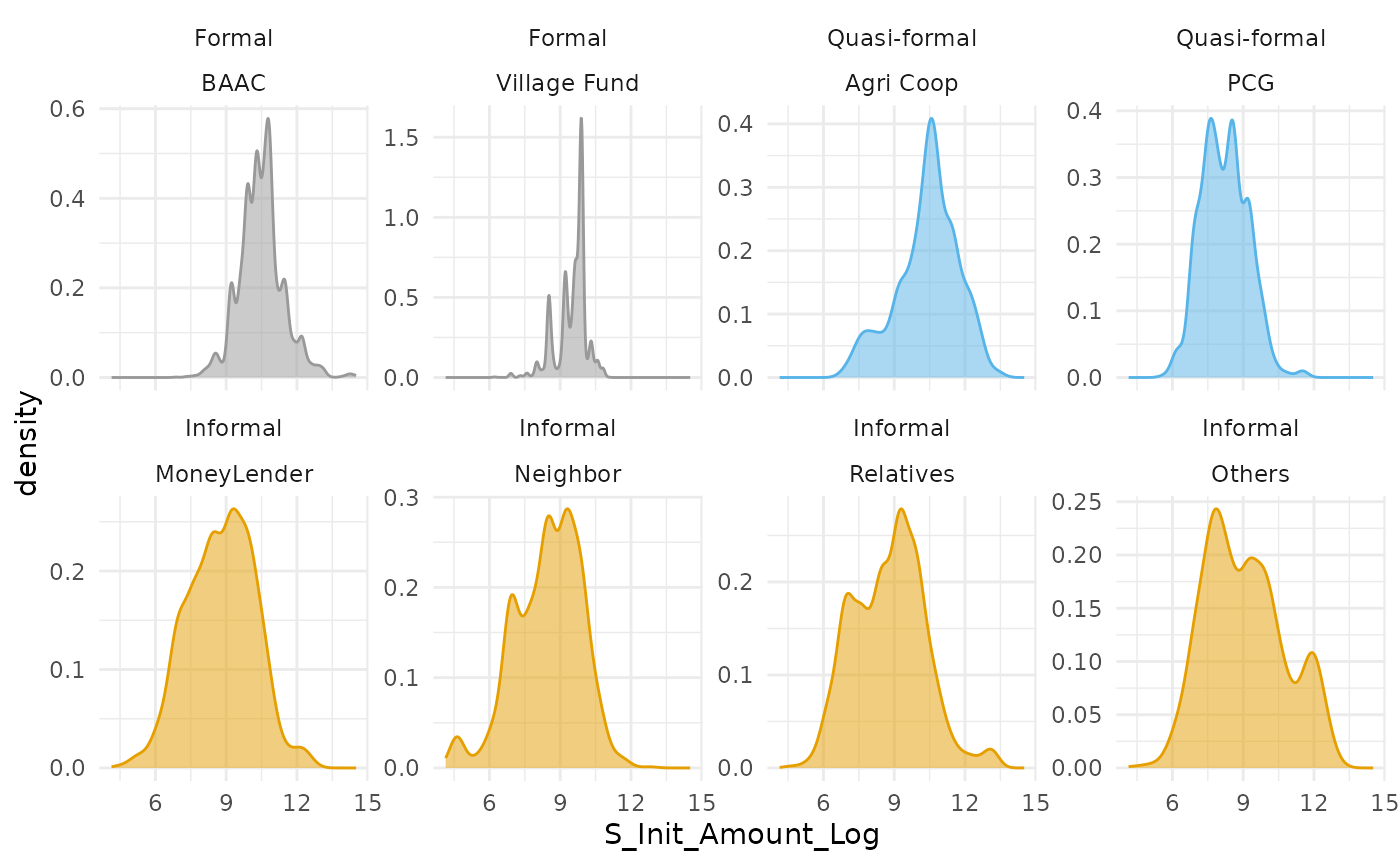

Loan amount key categories distributions

Compare eight key categories.

# # Density plot

# pl_loan_amount_density <- tstm_loans %>%

# mutate(S_Init_Amount_Log = log(S_Init_Amount)) %>%

# ggplot(aes(S_Init_Amount_Log,

# fill=formal, color=formal)) +

# geom_density(alpha=0.5, stat = "density", position = "identity") +

# facet_wrap(~ G_LenderType + formal, scales = "free_y") +

# theme_minimal()

# print(pl_loan_amount_density)

# Density plot

pl_loan_amount_density_1 <- tstm_loans %>%

filter(

G_LenderType != "Other Non-Indi Formal or Informal",

G_LenderType != "Commercial Bank",

) %>%

mutate(S_Init_Amount_Log = log(S_Init_Amount)) %>%

ggplot(aes(S_Init_Amount_Log,

fill = forinfm3, color = forinfm3

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

facet_wrap(factor(forinfm3, c(

"Formal",

"Quasi-formal",

"Informal"

)) ~

factor(G_LenderType,

levels = c(

"MoneyLender",

"Neighbor",

"Relatives",

"Others",

"BAAC",

"Village Fund",

# 'Commercial Bank',

"Agri Coop",

"PCG"

)

), scales = "free_y", ncol = 4) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

guides(color = FALSE, fill = FALSE) +

theme_minimal()

print(pl_loan_amount_density_1)

#> Warning: Removed 6 rows containing non-finite outside the scale range

#> (`stat_density()`).

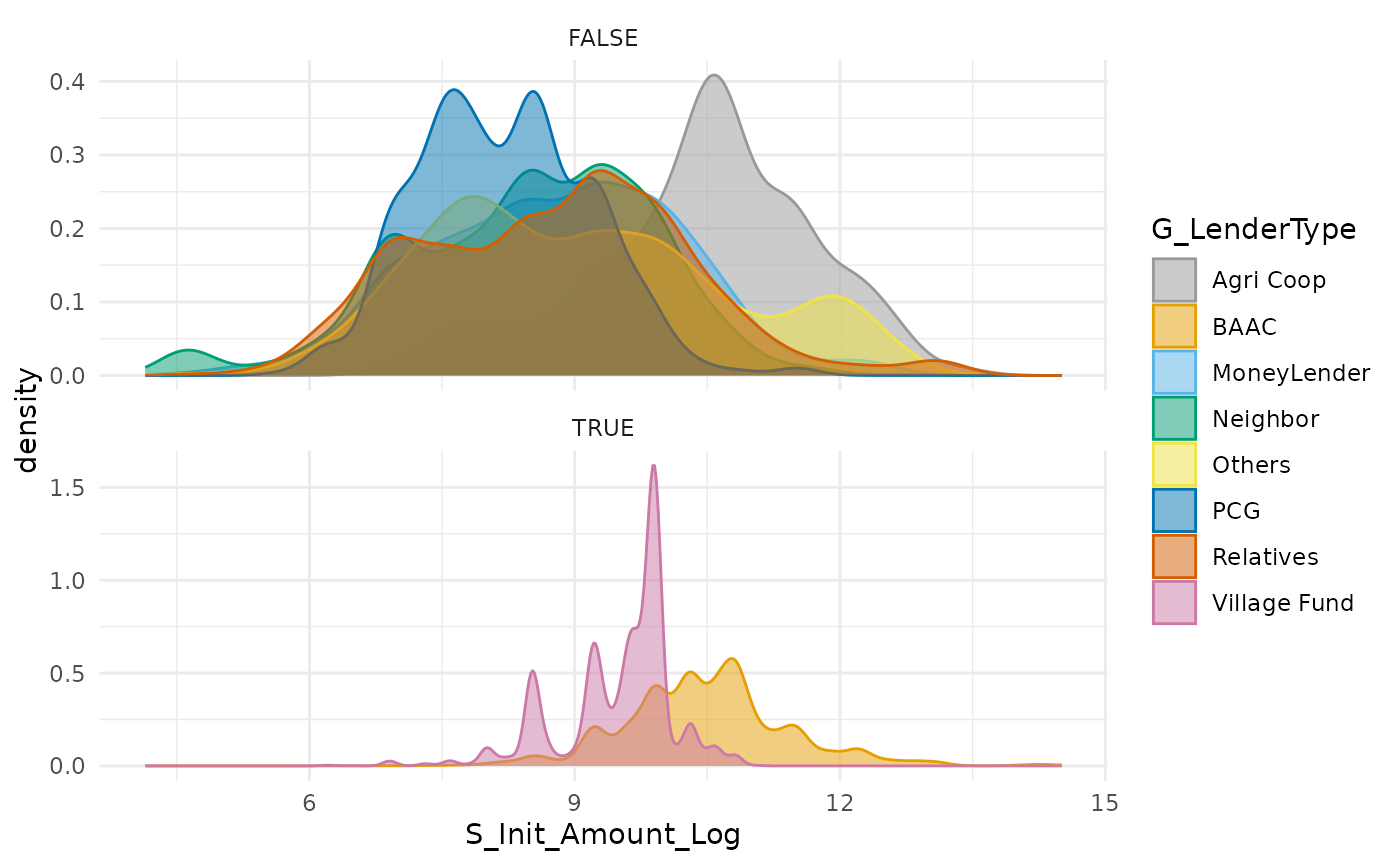

Compare distributions by formal and informal groupings, individual categories overlapping.

pl_loan_amount_density_2 <- tstm_loans %>%

filter(

G_LenderType != "Other Non-Indi Formal or Informal",

G_LenderType != "Commercial Bank",

) %>%

mutate(S_Init_Amount_Log = log(S_Init_Amount)) %>%

ggplot(aes(S_Init_Amount_Log,

fill = G_LenderType, color = G_LenderType

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

facet_wrap(~formal, scales = "free_y", ncol = 1) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

theme_minimal()

print(pl_loan_amount_density_2)

#> Warning: Removed 6 rows containing non-finite outside the scale range

#> (`stat_density()`).

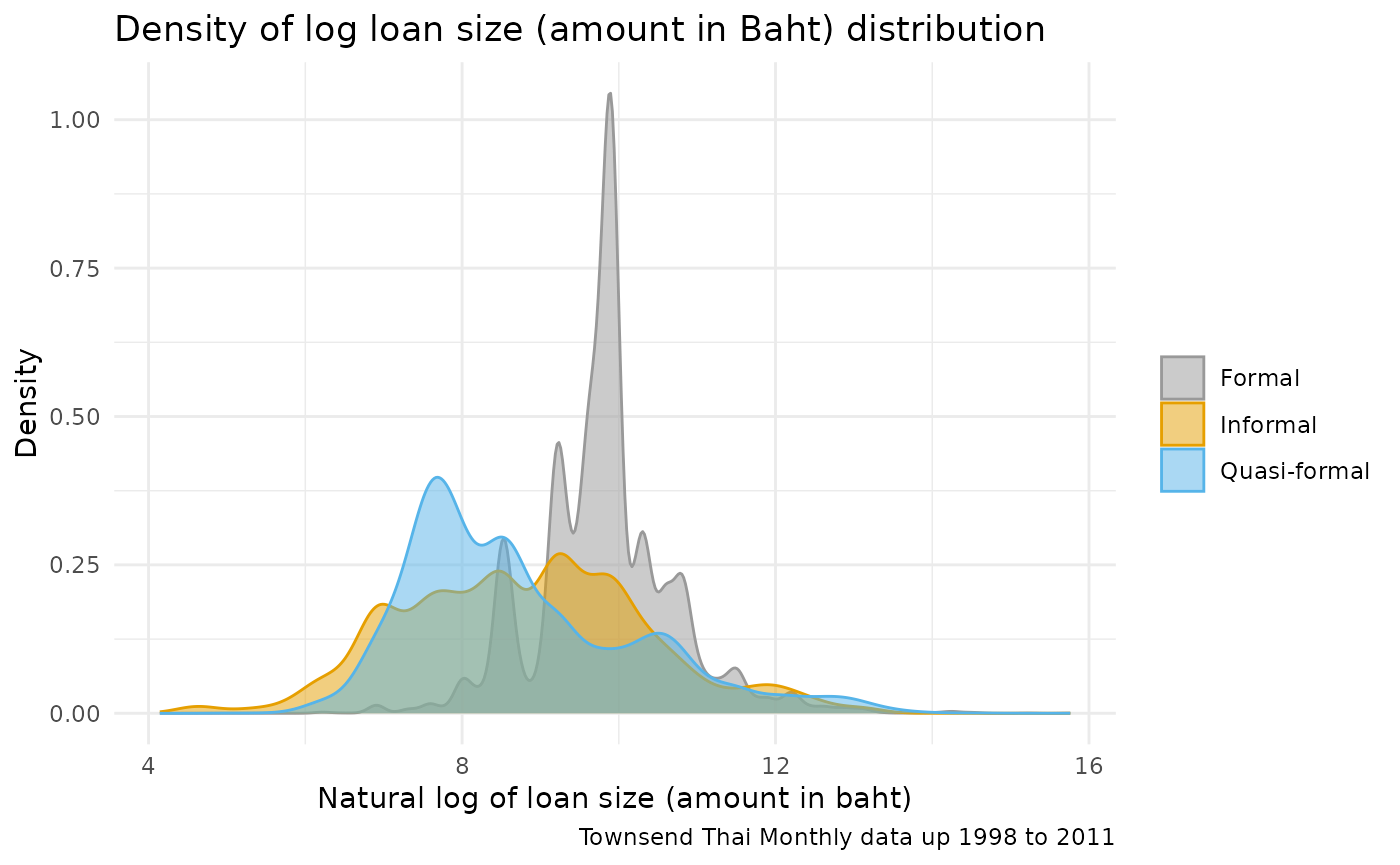

Loan amount formal vs informal vs quasi

pl_density_loan_size_forinfm3 <- tstm_loans %>%

mutate(S_Init_Amount_Log = log(S_Init_Amount)) %>%

ggplot(aes(S_Init_Amount_Log,

fill = forinfm3, color = forinfm3

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

scale_fill_manual(values = cbp1, name = "") +

scale_color_manual(values = cbp1, name = "") +

theme_minimal() +

labs(

x = paste0("Natural log of loan size (amount in baht)"),

y = paste0("Density"),

title = paste(

"Density of log loan size (amount in Baht) distribution",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_density_loan_size_forinfm3)

#> Warning: Removed 12 rows containing non-finite outside the scale range

#> (`stat_density()`).

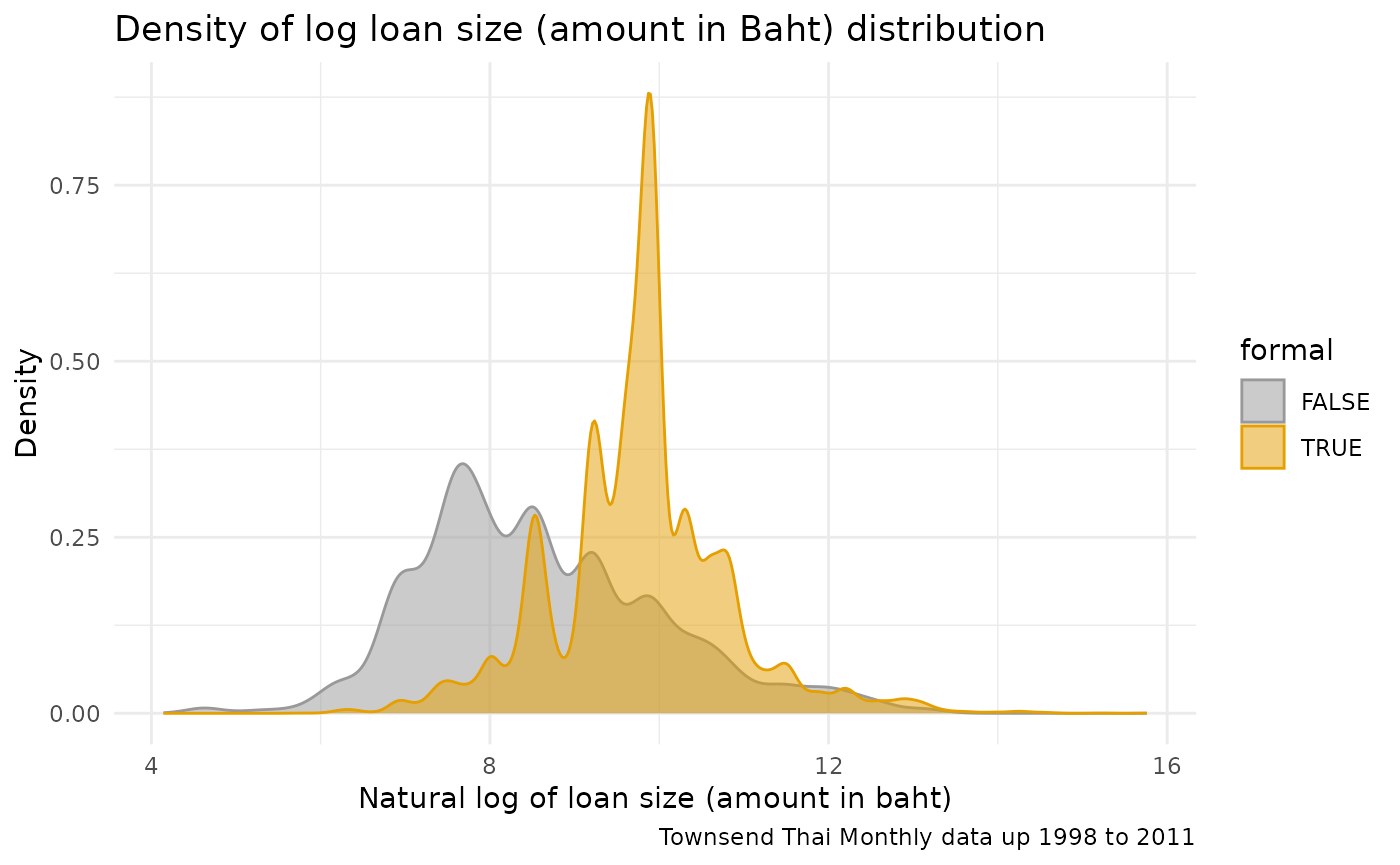

Loan amount formal vs informal distribution

Formal vs informal, density.

pl_density_loan_size_3 <- tstm_loans %>%

mutate(S_Init_Amount_Log = log(S_Init_Amount)) %>%

ggplot(aes(S_Init_Amount_Log,

fill = formal, color = formal

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

theme_minimal() +

labs(

x = paste0("Natural log of loan size (amount in baht)"),

y = paste0("Density"),

title = paste(

"Density of log loan size (amount in Baht) distribution",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_density_loan_size_3)

#> Warning: Removed 12 rows containing non-finite outside the scale range

#> (`stat_density()`).

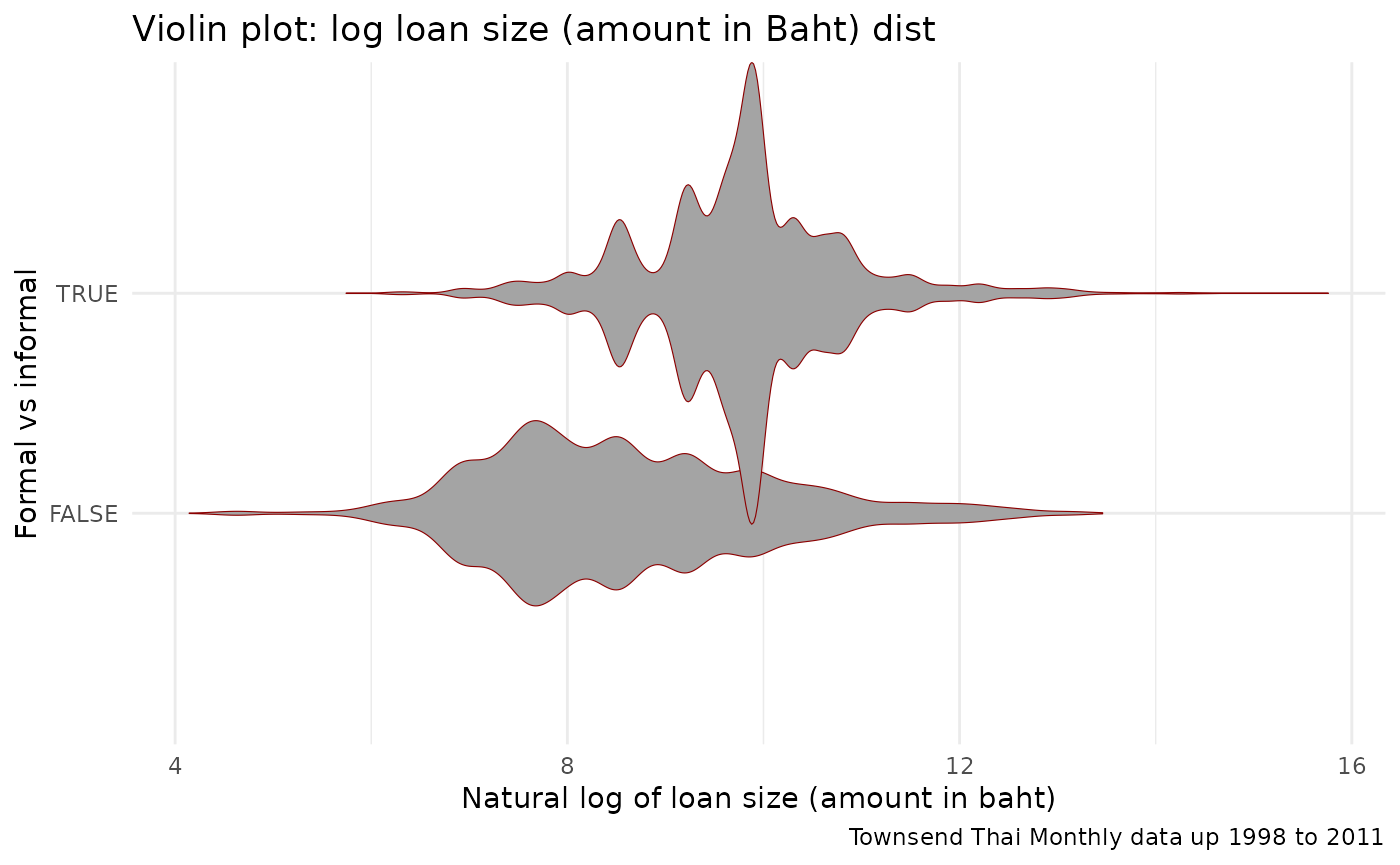

Formal vs informal bifurcation, violin.

# Figure B: Loan Amount by Lender Types

pl_loan_size <- tstm_loans %>%

mutate(S_Init_Amount_Log = log(S_Init_Amount)) %>%

# filter(G_Loan_Init_Length <= 24) %>%

ggplot(aes(x = formal, y = S_Init_Amount_Log)) +

geom_violin(

width = 2.1, size = 0.2,

fill = "#A4A4A4", color = "darkred"

) +

theme_minimal() +

coord_flip() +

labs(

y = paste0("Natural log of loan size (amount in baht)"),

x = paste0("Formal vs informal"),

title = paste(

"Violin plot: log loan size (amount in Baht) dist",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_loan_size)

#> Warning: Removed 12 rows containing non-finite outside the scale range

#> (`stat_ydensity()`).

#> Warning: `position_dodge()` requires non-overlapping x

#> intervals.

Loan interest rate distribution

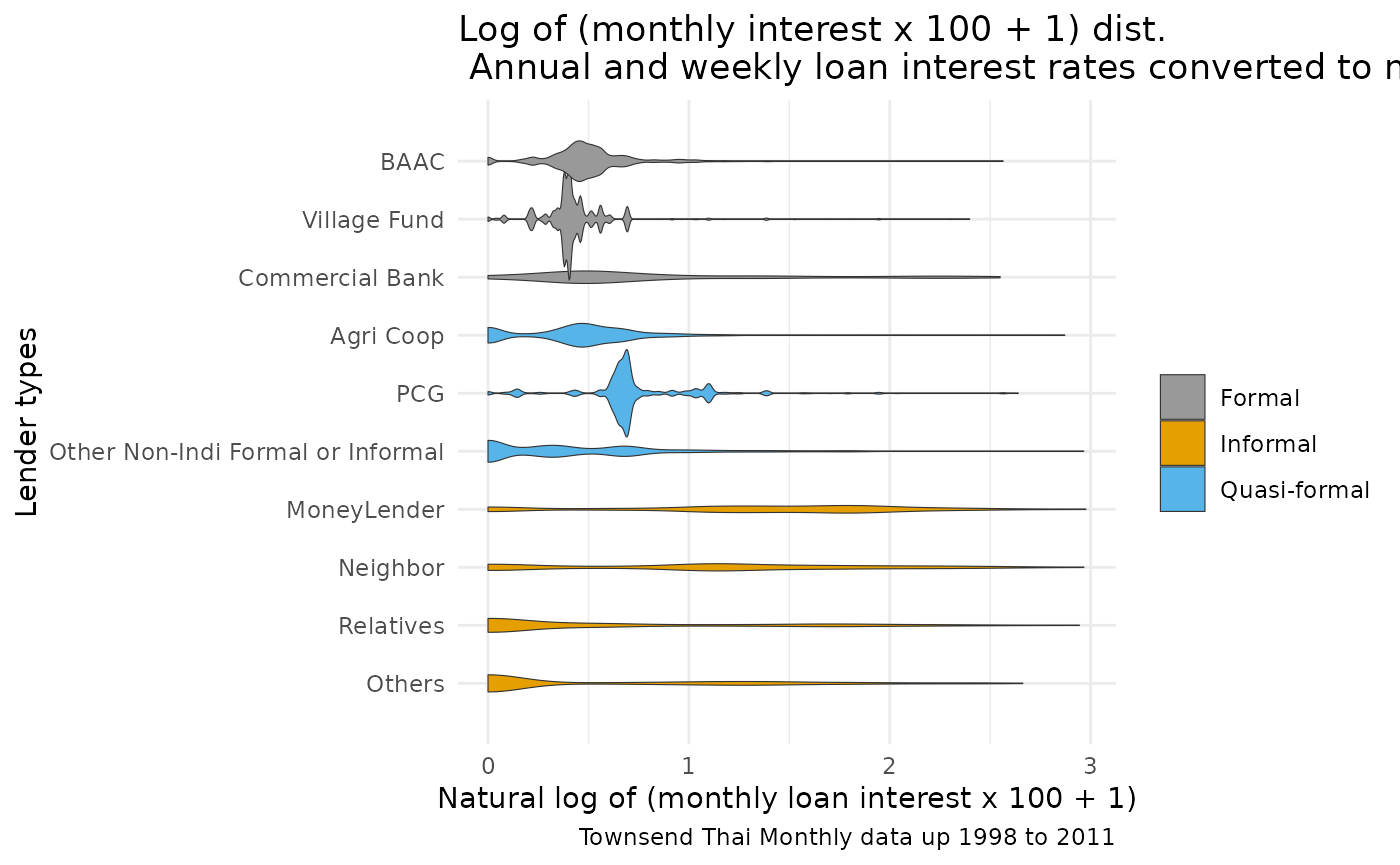

Interest rate all loan type violin plot

Overall and all types of lenders.

# Figure C: Interest Rate By Loan Types

pl_violin_loan_rate_all <- tstm_loans %>%

mutate(

G_Loan_Init_IntMthlyRat_Log =

log((G_Loan_Init_IntMthlyRat) * 100 + 1)

) %>%

filter(G_Loan_Init_IntMthlyRat_Log <= 3) %>%

# filter(G_Loan_Init_IntMthlyRat <= 0.15) %>%

ggplot(aes(x = factor(G_LenderType,

levels = rev(c(

"BAAC",

"Village Fund",

"Commercial Bank",

"Agri Coop",

"PCG",

"Other Non-Indi Formal or Informal",

"MoneyLender",

"Neighbor",

"Relatives",

"Others"

))

), y = G_Loan_Init_IntMthlyRat_Log, fill = forinfm3)) +

geom_violin(

width = 2.1, size = 0.2

) +

scale_fill_manual(values = cbp1, name = "") +

theme_minimal() +

coord_flip() +

labs(

y = paste0("Natural log of (monthly loan interest x 100 + 1)"),

# y = paste0("Monthly loan interest"),

x = paste0("Lender types"),

title = paste(

# "Monthly interest distribution (annual/weekly interest rates converted to monthly)",

"Log of (monthly interest x 100 + 1) dist.\n",

"Annual and weekly loan interest rates converted to monthly",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_violin_loan_rate_all)

#> Warning: `position_dodge()` requires non-overlapping x

#> intervals. ### Interest rate key categories distribution

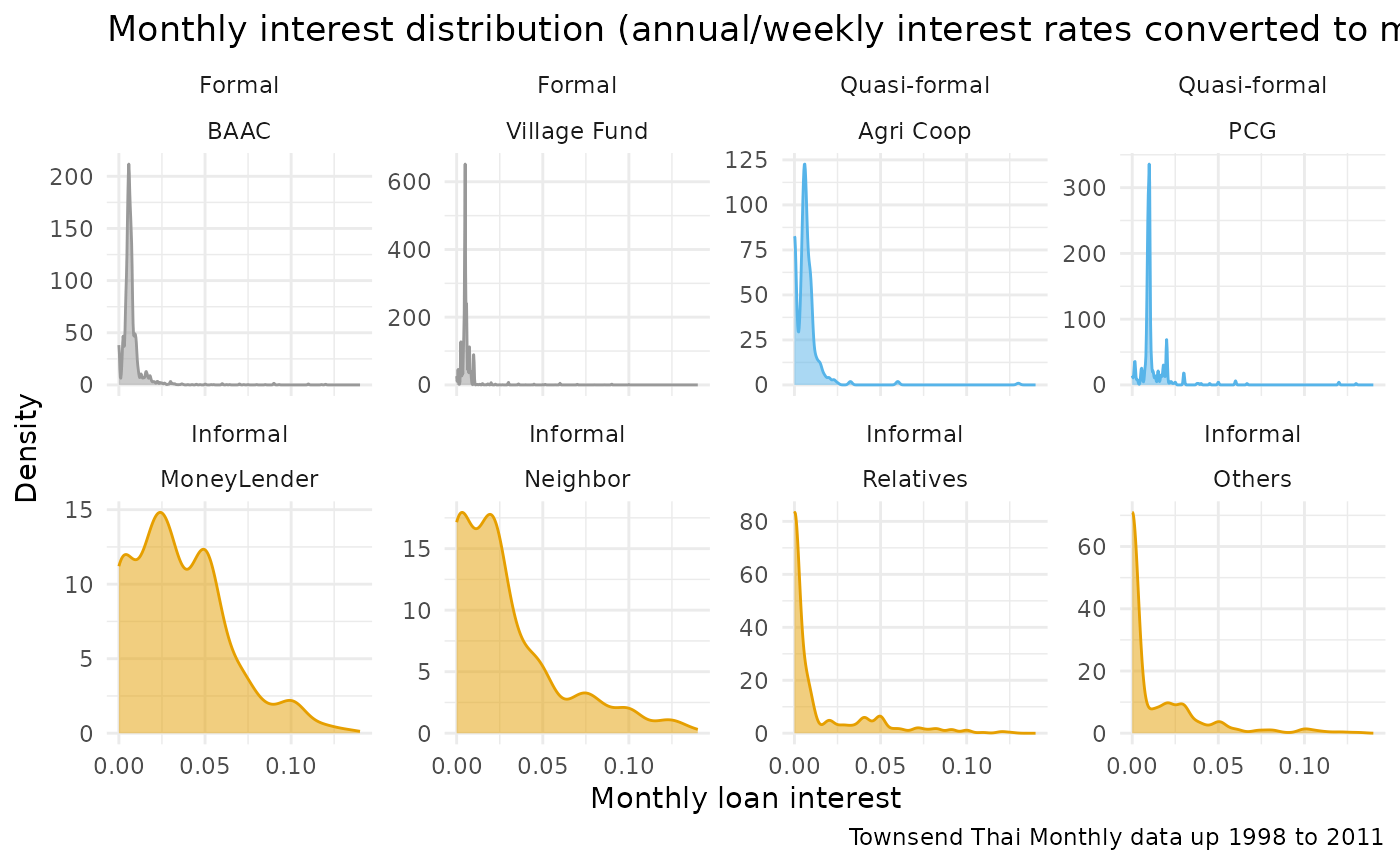

### Interest rate key categories distribution

Eight categories separate plots.

# Density plot

pl_density_loan_rate_forinfm3_bym8 <- tstm_loans %>%

filter(

G_LenderType != "Other Non-Indi Formal or Informal",

G_LenderType != "Commercial Bank",

) %>%

mutate(

G_Loan_Init_IntMthlyRat_Log =

log((G_Loan_Init_IntMthlyRat) * 100 + 1)

) %>%

filter(G_Loan_Init_IntMthlyRat <= 0.15) %>%

ggplot(aes(G_Loan_Init_IntMthlyRat,

fill = forinfm3, color = forinfm3

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

# facet_wrap(~ institutional + G_LenderType, scales = "free_y") +

facet_wrap(factor(forinfm3, c(

"Formal",

"Quasi-formal",

"Informal"

)) ~ factor(G_LenderType,

levels = c(

"MoneyLender",

"Neighbor",

"Relatives",

"Others",

"BAAC",

"Village Fund",

# 'Commercial Bank',

"Agri Coop",

"PCG"

)

), scales = "free_y", ncol = 4) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

guides(color = FALSE, fill = FALSE) +

theme_minimal() +

labs(

x = paste0("Monthly loan interest"),

y = "Density",

title = paste(

"Monthly interest distribution (annual/weekly interest rates converted to monthly)",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_density_loan_rate_forinfm3_bym8) Overlapping distributions grouped by formal and informal.

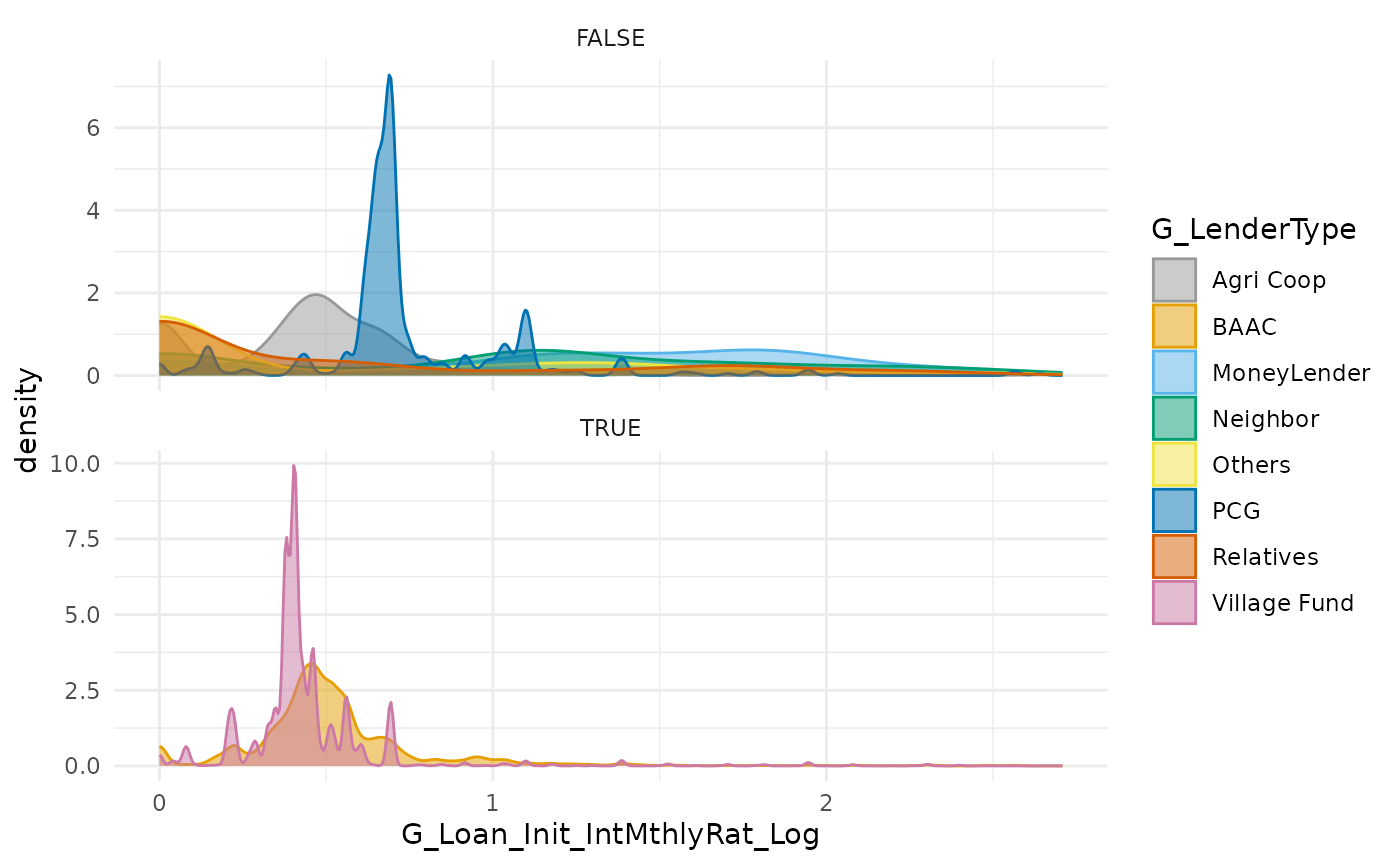

Overlapping distributions grouped by formal and informal.

# Density plot

pl_density_loan_rate_2 <- tstm_loans %>%

filter(

G_LenderType != "Other Non-Indi Formal or Informal",

G_LenderType != "Commercial Bank",

) %>%

mutate(

G_Loan_Init_IntMthlyRat_Log =

log((G_Loan_Init_IntMthlyRat) * 100 + 1)

) %>%

filter(G_Loan_Init_IntMthlyRat <= 0.15) %>%

ggplot(aes(G_Loan_Init_IntMthlyRat_Log,

fill = G_LenderType, color = G_LenderType

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

# facet_wrap(~ institutional + G_LenderType, scales = "free_y") +

facet_wrap(~formal, scales = "free_y", ncol = 1) +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

theme_minimal()

print(pl_density_loan_rate_2) ### Interest rate formal vs informal vs quasi

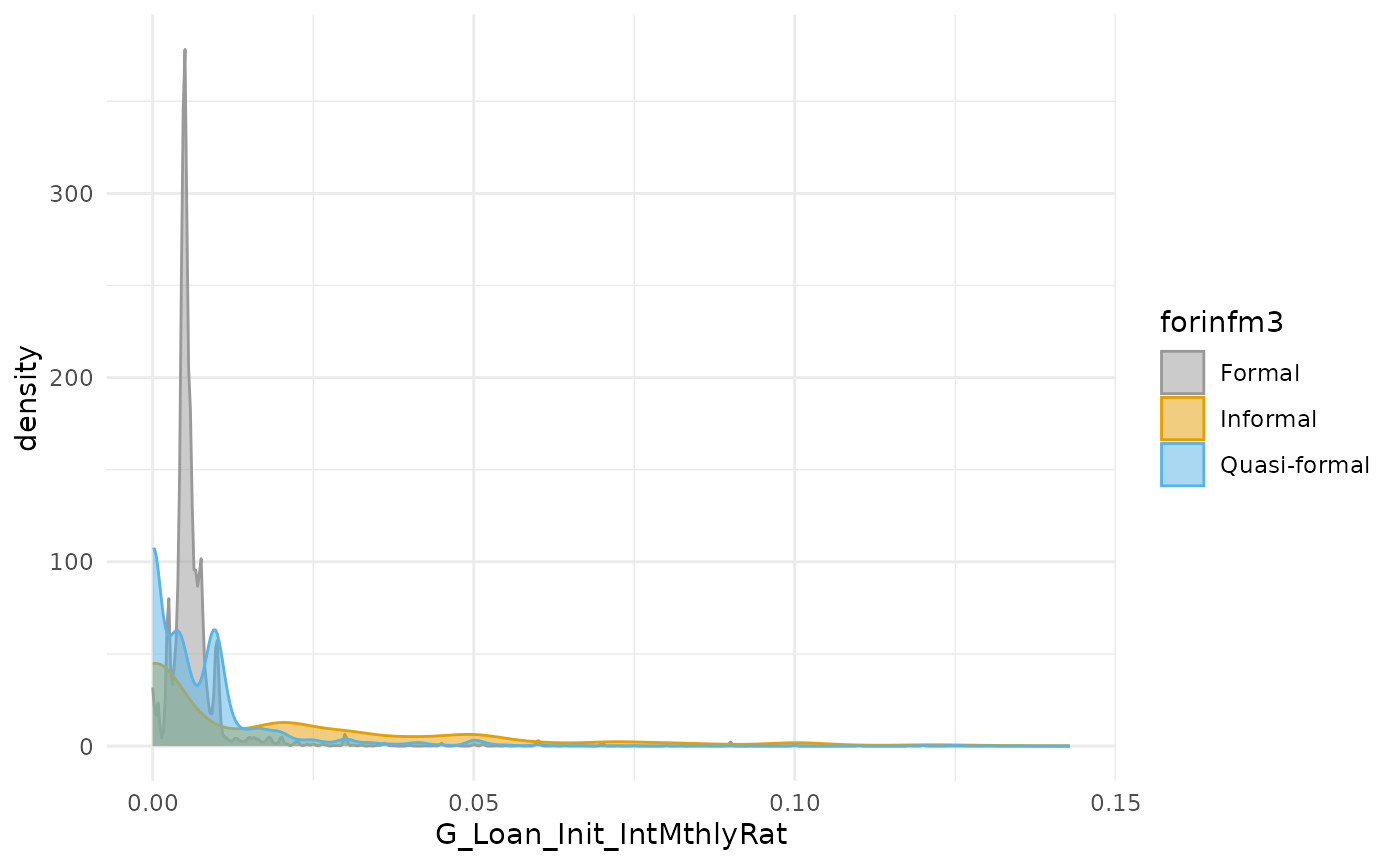

### Interest rate formal vs informal vs quasi

# Density plot,

pl_density_loan_rate_4 <- tstm_loans %>%

filter(G_Loan_Init_IntMthlyRat <= 0.15) %>%

ggplot(aes(G_Loan_Init_IntMthlyRat,

fill = forinfm3, color = forinfm3

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

theme_minimal()

print(pl_density_loan_rate_4)

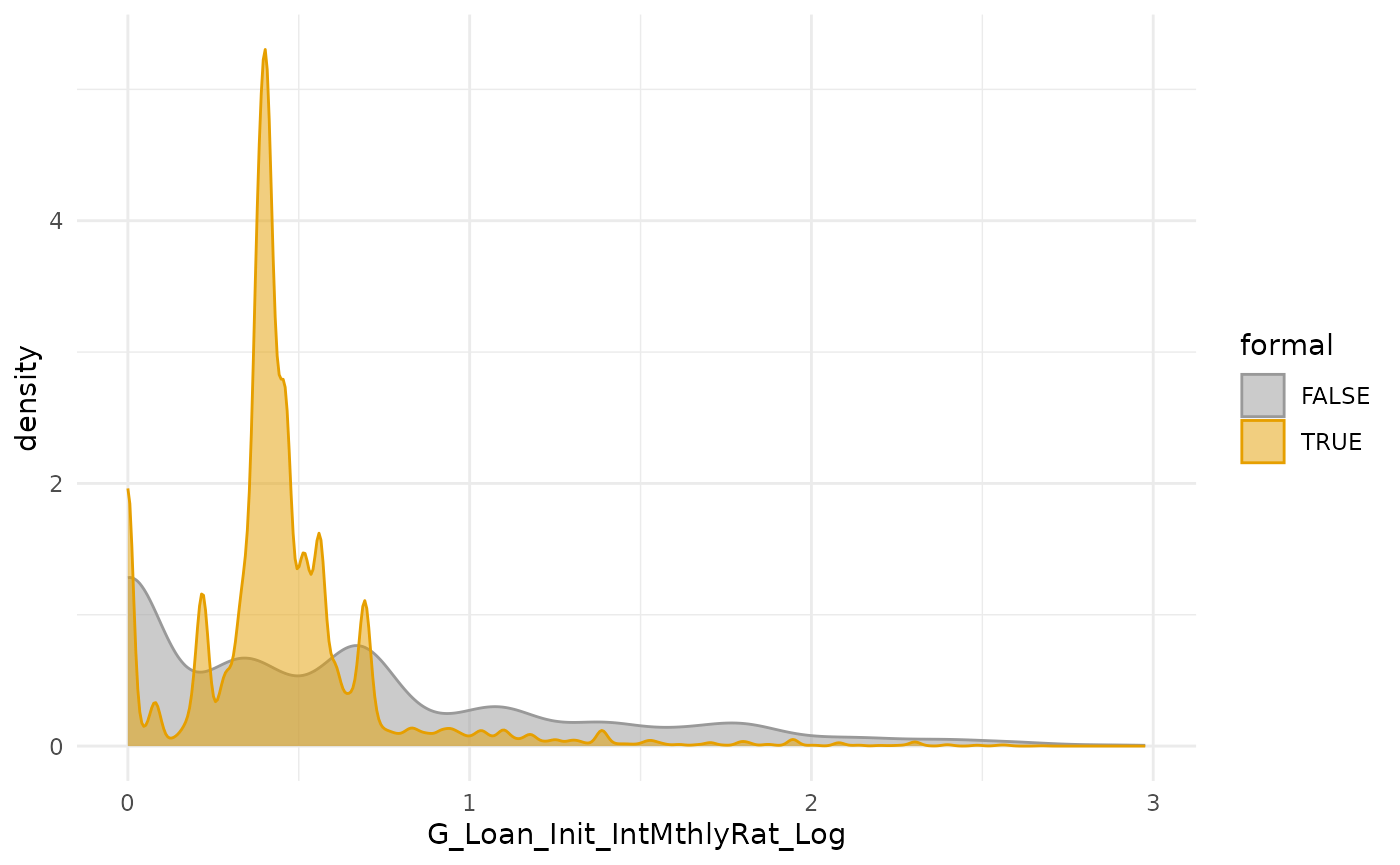

Interest rate formal vs informal

Formal vs informal density.

# Density plot

pl_density_loan_rate_3 <- tstm_loans %>%

mutate(

G_Loan_Init_IntMthlyRat_Log =

log((G_Loan_Init_IntMthlyRat) * 100 + 1)

) %>%

filter(G_Loan_Init_IntMthlyRat_Log <= 3) %>%

ggplot(aes(G_Loan_Init_IntMthlyRat_Log,

fill = formal, color = formal

)) +

geom_density(alpha = 0.5, stat = "density", position = "identity") +

scale_fill_manual(values = cbp1) +

scale_color_manual(values = cbp1) +

theme_minimal()

print(pl_density_loan_rate_3)

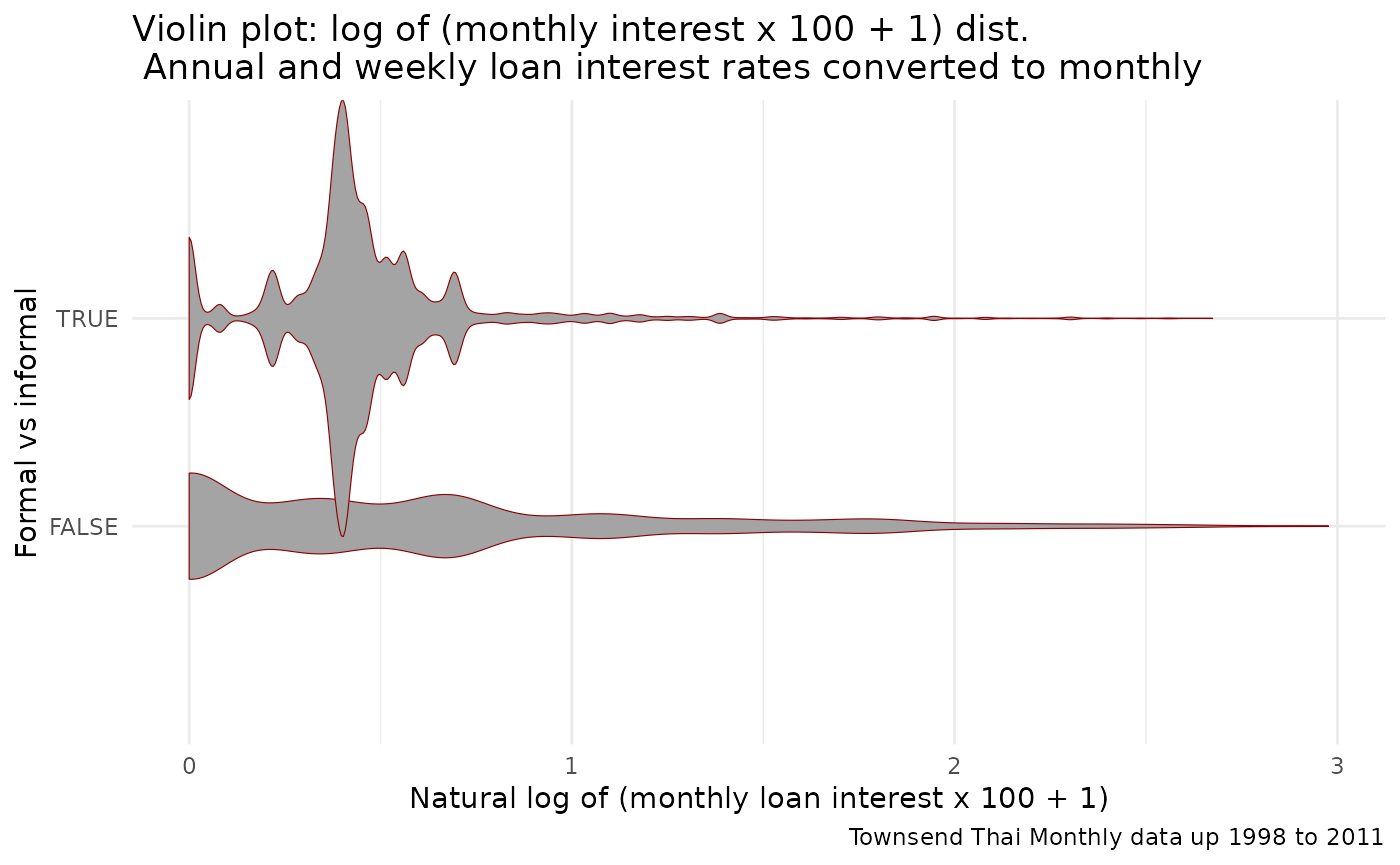

Formal vs informal bifurcation via violin plots.

# Figure C: Interest Rate By Loan Types

pl_loan_rate <- tstm_loans %>%

mutate(

G_Loan_Init_IntMthlyRat_Log =

log((G_Loan_Init_IntMthlyRat) * 100 + 1)

) %>%

filter(G_Loan_Init_IntMthlyRat_Log <= 3) %>%

ggplot(aes(x = formal, y = G_Loan_Init_IntMthlyRat_Log)) +

geom_violin(

width = 2.1, size = 0.2,

fill = "#A4A4A4", color = "darkred"

) +

theme_minimal() +

coord_flip() +

labs(

y = paste0("Natural log of (monthly loan interest x 100 + 1)"),

x = paste0("Formal vs informal"),

title = paste(

"Violin plot: log of (monthly interest x 100 + 1) dist.\n",

"Annual and weekly loan interest rates converted to monthly",

sep = " "

),

caption = paste(

"Townsend Thai Monthly data up 1998 to 2011",

sep = ""

)

)

print(pl_loan_rate)

#> Warning: `position_dodge()` requires non-overlapping x

#> intervals.

Saving Figures

Now we save the figures we have generates

if (bl_save_figs) {

# Project root

spt_root_prj <- ffs_hfid_path()$spt_root_prj_main_dropbox

ar_it_save_group <- c(1, 2, 3)

for (it_grp in ar_it_save_group) {

# Path

spt_img_folder <- file.path(

spt_root_prj,

"summ", "summ_loan_terms_dist", "res_2023_1211",

fsep = .Platform$file.sep

)

if (it_grp == 1) {

# Plots and names

# plots

ls_plts <- list(

pl_violin_loan_length_all,

pl_bar_loan_length_1a, pl_bar_loan_length_1b,

pl_bar_loan_length_2a, pl_bar_loan_length_2b

)

# Names

ls_plts_names <- c(

"pl_violin_loan_length_all",

"pl_bar_loan_length_1a", "pl_bar_loan_length_1b",

"pl_bar_loan_length_2a", "pl_bar_loan_length_2b"

)

}

if (it_grp == 2) {

# Plots and names

# plots

ls_plts <- list(

pl_violin_loan_size_all,

pl_density_loan_size_forinfm3

)

# Names

ls_plts_names <- c(

"pl_violin_loan_size_all",

"pl_density_loan_size_forinfm3"

)

}

if (it_grp == 3) {

# Plots and names

# plots

ls_plts <- list(

pl_violin_loan_rate_all,

pl_density_loan_rate_forinfm3_bym8

)

# Names

ls_plts_names <- c(

"pl_violin_loan_rate_all",

"pl_density_loan_rate_forinfm3_bym8"

)

}

# Save plot one by one

it_len_figs <- length(ls_plts_names)

for (it_fig in 1:1:it_len_figs) {

# Get plot

pl_fig <- ls_plts[[it_fig]]

st_fig_name <- ls_plts_names[it_fig]

# Image save path

spn_graph_png <- file.path(spt_img_folder, paste0(st_fig_name, ".png"),

fsep = .Platform$file.sep

)

spn_graph_eps <- file.path(spt_img_folder, paste0(st_fig_name, ".eps"),

fsep = .Platform$file.sep

)

# Plot

print(pl_fig)

png(spn_graph_png,

width = 250,

height = 150, units = "mm",

res = 150, pointsize = 7

)

ggsave(spn_graph_eps,

plot = last_plot(),

device = "eps",

path = NULL,

scale = 1,

width = 250,

height = 150,

units = c("mm"),

dpi = 150,

limitsize = TRUE

)

print(pl_fig)

dev.off()

}

}

}